Starbucks (NasdaqGS:SBUX) Declines 12% In Last Quarter With US$0.61 Dividend Amid Market Challenges

Starbucks (NasdaqGS:SBUX) recently affirmed a quarterly dividend of $0.61 per share, underscoring its commitment to returning value to shareholders amidst a challenging economic landscape. Over the last quarter, the company's stock price decreased by 11.84%, a move that coincides with the broader market downturn, including a 6% drop in the S&P 500 and the Nasdaq entering bear market territory due to global tariff tensions. Despite impactful initiatives such as the food security partnership with The Global FoodBanking Network, Starbucks, like many companies, has been influenced by macroeconomic factors, highlighting the interconnected nature of global markets.

Every company has risks, and we've spotted 3 weaknesses for Starbucks (of which 1 is significant!) you should know about.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Starbucks' recent dividend affirmation highlights its commitment to shareholder value but comes amidst short-term stock declines and industry challenges. The stock's performance, with an 11.84% drop recently, contrasts with its longer-term return of 23.75% over five years. This performance notably surpasses the US Hospitality industry's one-year decline of 8.10%. These figures suggest that while Starbucks faces immediate economic pressures, its long-term strategy remains favorable for investors.

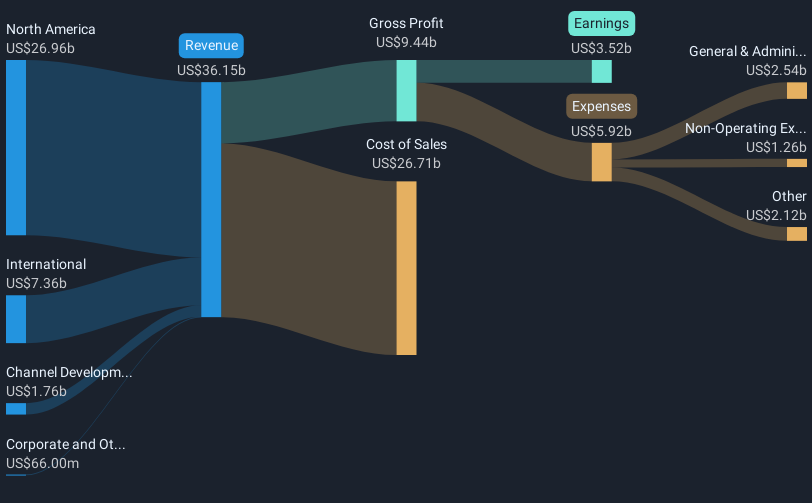

This dividend decision, coupled with strategic moves, could impact revenue and earnings forecasts. The emphasis on digital initiatives and store expansion is expected to drive revenue growth, projected to increase annually by 6.9% as per analysts. However, earnings forecasts could be challenged by rising costs and dependency on labor and technological investments. Analysts predict earnings to rise to US$5.20 billion by April 2028, but achieving this will require overcoming macroeconomic hurdles and internal cost management issues.

Currently, Starbucks trades at US$98.23, below the analyst consensus price target of US$107.51, implying an 8.60% potential upside. This discrepancy indicates a belief that, despite near-term setbacks, Starbucks might be undervalued if it achieves projected growth. Nevertheless, analysts remain divided, underscoring the importance of considering both investment risks and opportunities in the company's strategic trajectory. Given Starbucks’ five-year returns, investors should carefully weigh these factors against market conditions and industry averages.

Evaluate Starbucks' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10