Promising Penny Stocks To Consider In April 2025

Amid ongoing tariff uncertainties and volatile trading, the U.S. stock market is experiencing significant fluctuations, with major indices like the Dow Jones Industrial Average and S&P 500 facing substantial declines. In such a turbulent landscape, investors may find opportunities in penny stocks—an investment category that, despite its outdated name, continues to offer potential value. By focusing on companies with robust financials and clear growth trajectories, investors might uncover promising options among these smaller or newer enterprises.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.23 | $338.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.47 | $1.47B | ✅ 3 ⚠️ 3 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $2.6256 | $7.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.16 | $52.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.46 | $73.57M | ✅ 5 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.50 | $330.99M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.27 | $68.85M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.77 | $5.59M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $213.14M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.6734 | $60.57M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 784 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Broadwind (NasdaqCM:BWEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Broadwind, Inc. is involved in the manufacturing and sales of structures, equipment, and components for clean technology and other specialized applications in the United States, with a market cap of $35.27 million.

Operations: Broadwind generates its revenue from three main segments: Gearing ($35.59 million), Heavy Fabrications ($82.66 million), and Industrial Solutions ($26.06 million).

Market Cap: $35.27M

Broadwind, Inc., with a market cap of US$35.27 million, operates in manufacturing for clean technology and other specialized sectors. Despite its seasoned management and board, Broadwind faces challenges as recent earnings showed a net loss of US$0.914 million for Q4 2024 compared to a profit the previous year. The company's debt is well covered by operating cash flow, yet interest payments are not well covered by EBIT. While trading below estimated fair value, profitability has declined recently with margins dropping from 3.8% to 0.8%. Revenue guidance for 2025 is set between US$140 million and US$160 million.

- Dive into the specifics of Broadwind here with our thorough balance sheet health report.

- Understand Broadwind's earnings outlook by examining our growth report.

Equillium (NasdaqCM:EQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Equillium, Inc. is a clinical-stage biotechnology company focused on developing products for severe autoimmune and immuno-inflammatory disorders with unmet medical needs, and it has a market cap of $16.83 million.

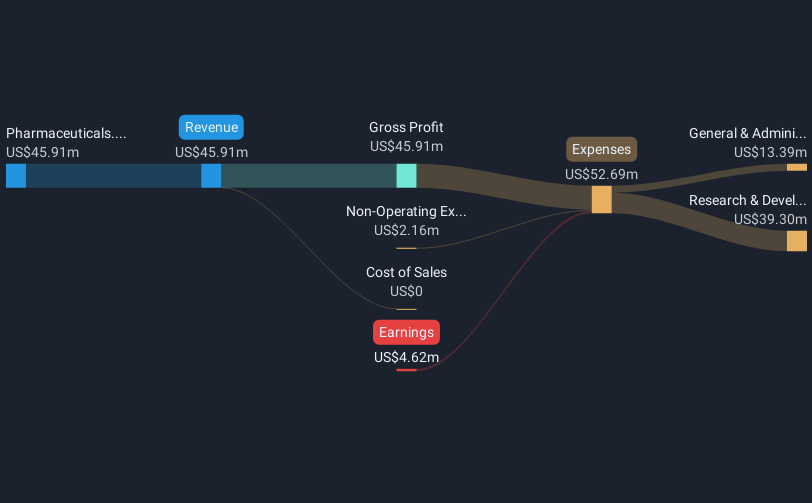

Operations: The company's revenue is derived entirely from its Pharmaceuticals segment, amounting to $41.10 million.

Market Cap: $16.83M

Equillium, Inc., with a market cap of US$16.83 million, is navigating the complexities of the biotechnology sector amid its ongoing unprofitability. The company reported annual sales of US$41.1 million for 2024, showing an increase from the previous year, though it remains unprofitable with a net loss of US$8.07 million. Recent Phase 3 trial results for itolizumab in acute graft-versus-host disease showed promising long-term outcomes despite initial response rates not differing significantly from placebo. Despite having no debt and sufficient short-term assets to cover liabilities, auditors have expressed doubts about Equillium's ability to continue as a going concern due to financial challenges and cash runway limitations under current conditions.

- Click here to discover the nuances of Equillium with our detailed analytical financial health report.

- Assess Equillium's future earnings estimates with our detailed growth reports.

Ispire Technology (NasdaqCM:ISPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ispire Technology Inc. is engaged in the research, development, design, commercialization, sales, marketing, and distribution of e-cigarettes and cannabis vaping products globally with a market cap of $159.85 million.

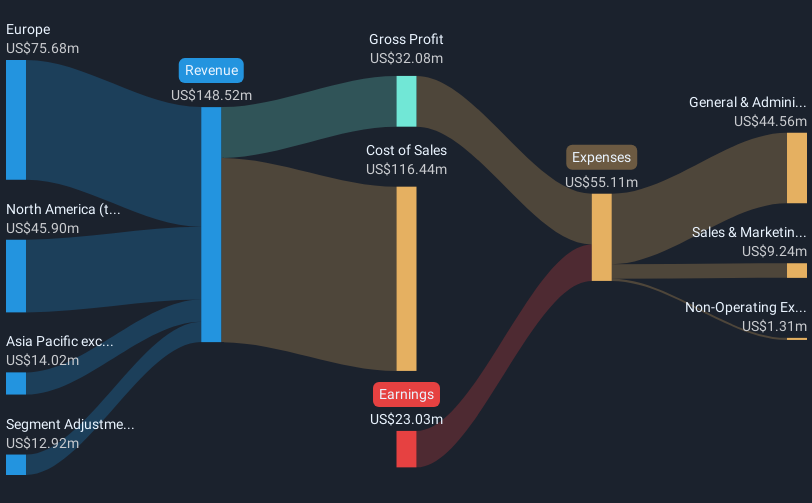

Operations: The company generates $148.52 million in revenue from its cigarette manufacturers segment.

Market Cap: $159.85M

Ispire Technology Inc., with a market cap of US$159.85 million, is experiencing financial challenges despite its global presence in e-cigarettes and cannabis vaping products. The company reported second-quarter sales of US$41.83 million, but net losses widened to US$8 million compared to the previous year. Despite being debt-free and having sufficient short-term assets to cover liabilities, Ispire's negative return on equity highlights ongoing unprofitability issues. Recent strategic moves include a secured promissory note for $20 million and an international product launch in Africa, which aims to expand its retail footprint significantly over the coming months.

- Jump into the full analysis health report here for a deeper understanding of Ispire Technology.

- Examine Ispire Technology's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Click here to access our complete index of 784 US Penny Stocks.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ispire Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10