US Market's Undiscovered Gems 3 Small Caps with Strong Potential

In recent days, the U.S. stock market has faced significant volatility, with major indices like the Dow Jones and S&P 500 experiencing sharp declines due to new tariff announcements by President Trump. Amid this turbulent backdrop, small-cap stocks in the S&P 600 have drawn attention as potential opportunities for investors seeking growth outside of larger, more established companies. In such an environment, identifying small-cap stocks with strong fundamentals and solid growth prospects can be a strategic approach for those looking to navigate market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Click here to see the full list of 279 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is a bank holding company for Citizens & Northern Bank, offering diverse banking and related services to individual and corporate clients, with a market cap of $308.70 million.

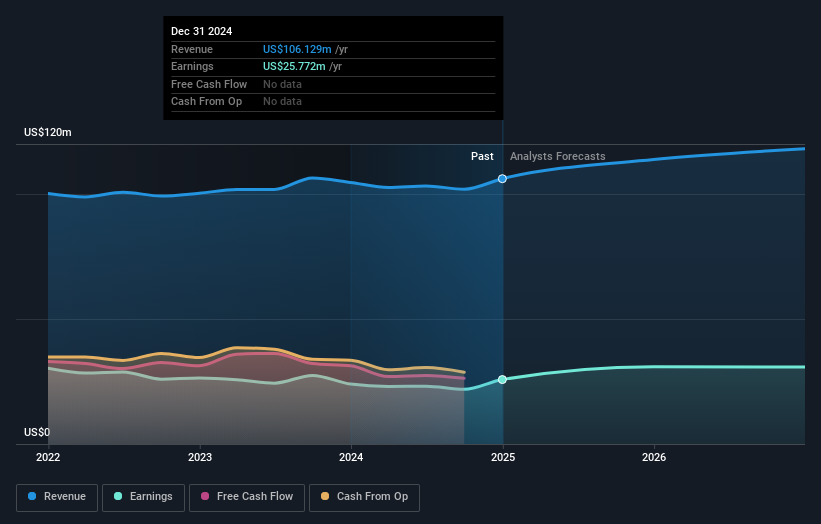

Operations: Citizens & Northern generates revenue primarily through its community banking segment, which contributed $106.13 million. The company's financial performance is influenced by various factors, including interest rates and loan demand, which affect its net profit margin.

Citizens & Northern, with total assets of US$2.6 billion and equity of US$275.3 million, showcases a strong foundation in the financial sector. Total deposits stand at US$2.1 billion against loans amounting to US$1.9 billion, reflecting a net interest margin of 3.3%. The bank's earnings growth over the past year at 7.4% outpaces the industry average by a significant margin, while its allowance for bad loans is considered low at 84%. Trading well below our fair value estimate by 44.7%, it appears undervalued with primarily low-risk funding sources comprising 90% customer deposits.

- Take a closer look at Citizens & Northern's potential here in our health report.

Assess Citizens & Northern's past performance with our detailed historical performance reports.

First Community Bankshares (NasdaqGS:FCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: First Community Bankshares, Inc. serves as the financial holding company for First Community Bank, offering a range of banking products and services with a market cap of $689.08 million.

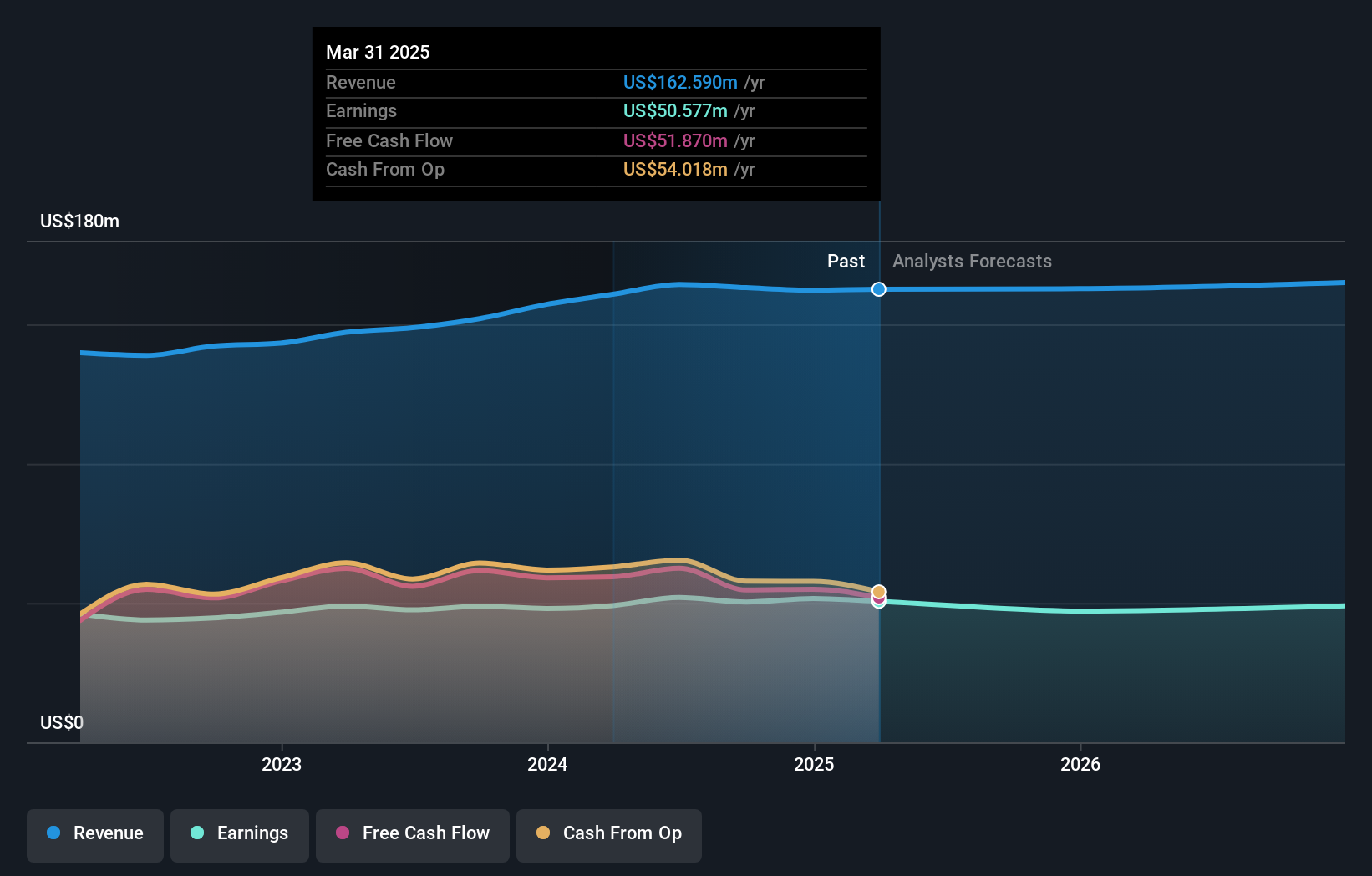

Operations: First Community Bankshares generates revenue primarily through its community banking segment, which accounts for $162.26 million.

With total assets of US$3.3 billion and equity of US$526.4 million, First Community Bankshares stands out with a net interest margin of 4.4%. Its robust approach to risk management is evident in the sufficient allowance for bad loans at 174% and non-performing loans at just 0.8%. The company reported earnings growth of 7.5% over the past year, surpassing industry averages, while trading at nearly 30% below its estimated fair value suggests potential upside for investors. Despite recent net charge-offs rising to US$1.48 million, consistent dividend payouts and low-risk funding sources bolster confidence in its stability.

- Click here and access our complete health analysis report to understand the dynamics of First Community Bankshares.

Gain insights into First Community Bankshares' past trends and performance with our Past report.

Douglas Dynamics (NYSE:PLOW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Douglas Dynamics, Inc. is a North American manufacturer and upfitter specializing in commercial work truck attachments and equipment, with a market cap of approximately $537.27 million.

Operations: Douglas Dynamics generates revenue primarily from its Work Truck Solutions segment, which contributed $312.49 million, and the Work Truck Attachments segment with $256.01 million.

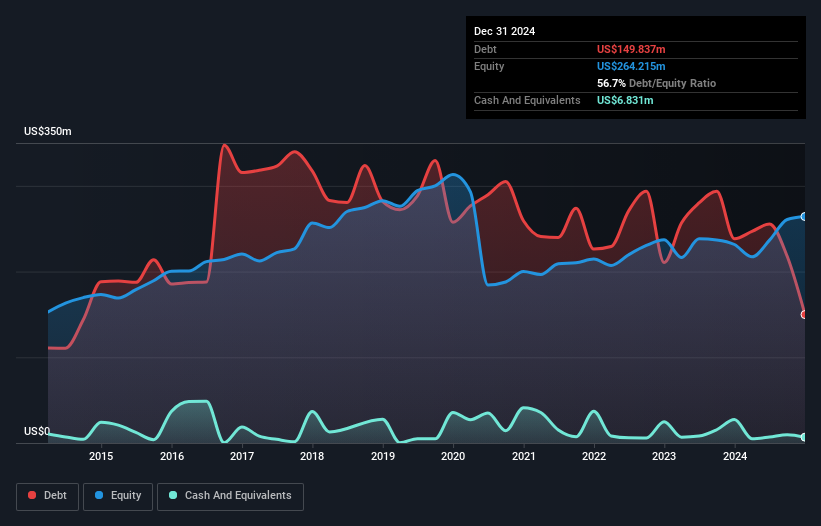

Douglas Dynamics, a key player in the commercial work truck attachments industry, has recently appointed Mark Van Genderen as CEO. This leadership change follows an impressive year where earnings soared by 137%, outpacing the machinery sector's growth of 8.6%. Despite a high net debt to equity ratio of 54%, their interest payments are well covered at 3.1 times EBIT. A one-off gain of US$41M impacted recent financial results, but ongoing revenue is expected to grow annually by 8.45%. The company trades significantly below its estimated fair value, presenting potential for investors seeking undervalued opportunities in this niche market segment.

- Douglas Dynamics' Solutions segment benefits from long-term contracts and a record backlog. Click here to explore the narrative on Douglas Dynamics' strategic growth initiatives and market performance.

Summing It All Up

- Unlock our comprehensive list of 279 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade First Community Bankshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10