3 Global Penny Stocks With Market Caps Over US$200M

Global markets have shown mixed performance recently, with U.S. stocks rebounding after multi-week declines and European indices experiencing modest gains amid trade-related uncertainties. In this context, penny stocks—often smaller or newer companies—continue to capture investor interest due to their potential for growth and affordability. While the term may seem outdated, these stocks can still offer opportunities when backed by strong financials and a clear growth path.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.47 | SGD9.76B | ✅ 5 ⚠️ 0 View Analysis > |

| NEXG Berhad (KLSE:DSONIC) | MYR0.26 | MYR723.36M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.93 | HK$45.73B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.28 | HK$813.93M | ✅ 3 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.035 | £301.85M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.63 | £412.89M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.732 | £2.07B | ✅ 5 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.08 | A$151.37M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,723 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

Town Health International Medical Group (SEHK:3886)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Town Health International Medical Group Limited operates as an investment holding company offering healthcare and related services in the People's Republic of China and Hong Kong, with a market cap of HK$1.96 billion.

Operations: The company's revenue is primarily generated from three segments: Hong Kong Medical Services (HK$826.41 million), Hong Kong Managed Medical Network Business (HK$510.13 million), and Mainland Hospital Management and Medical Services (HK$533.79 million).

Market Cap: HK$1.96B

Town Health International Medical Group, with a market cap of HK$1.96 billion, generates revenue primarily from its Hong Kong and Mainland China healthcare services. Despite being unprofitable and showing a negative return on equity (-6.42%), the company has more cash than debt and maintains a significant cash runway exceeding three years due to positive free cash flow growth. Recent executive changes include the appointment of Mr. Huang Yu as an executive director, bringing extensive investment management experience from China Life Investment Holdings Co., Ltd., which could influence strategic directions amid its current financial challenges and new management dynamics.

- Dive into the specifics of Town Health International Medical Group here with our thorough balance sheet health report.

- Evaluate Town Health International Medical Group's historical performance by accessing our past performance report.

Peijia Medical (SEHK:9996)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peijia Medical Limited focuses on the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices, with a market cap of HK$3.25 billion.

Operations: The company's revenue is derived from two main segments: the Neurointerventional Business, which generated CN¥309.30 million, and the Transcatheter Valve Therapeutic Business, contributing CN¥208.16 million.

Market Cap: HK$3.25B

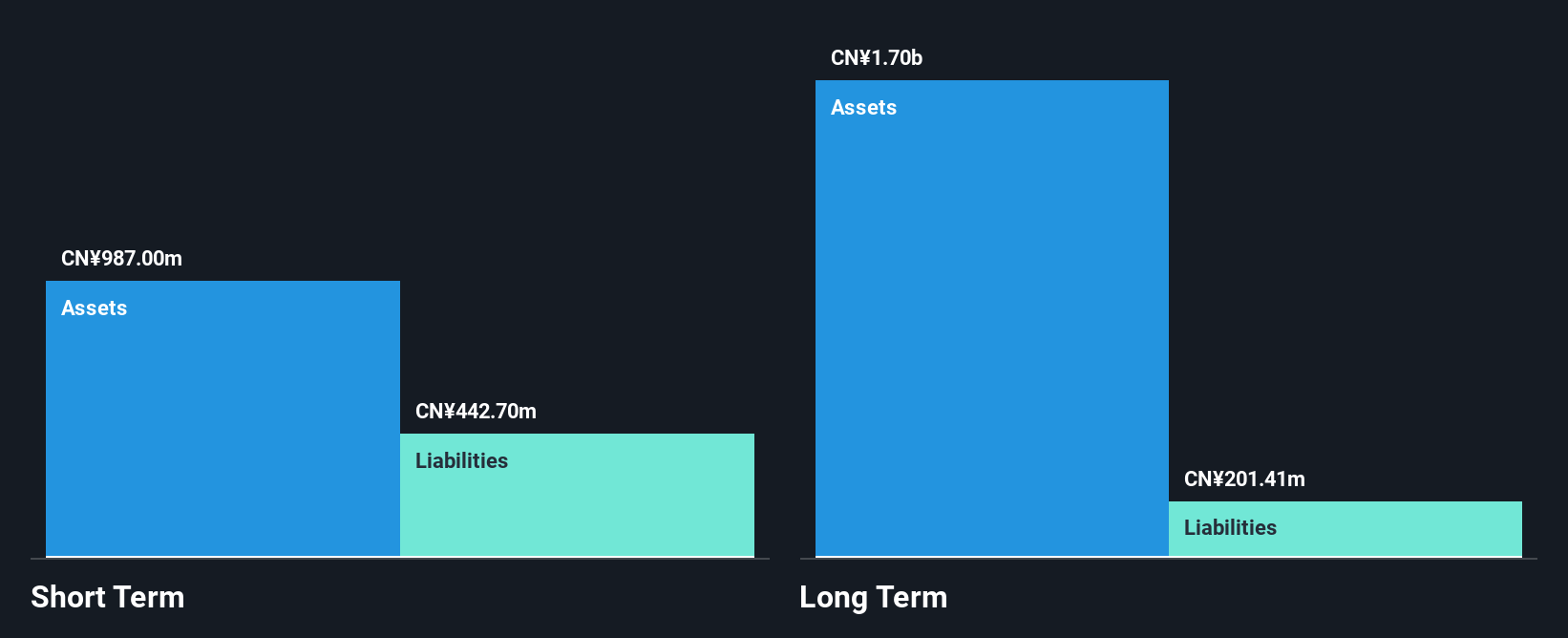

Peijia Medical, with a market cap of HK$3.25 billion, focuses on transcatheter valve therapeutic and neurointerventional devices. Despite being unprofitable, it has reduced losses by 38.7% annually over five years and maintains a stable cash runway exceeding three years due to more cash than debt. The company projects revenue growth to RMB 610-630 million for 2024, driven by its expanding share in the Chinese TAVR market and robust neurointerventional product sales. Recent achievements include the first successful implants of its TrilogyTM THV System in Taiwan for treating severe aortic conditions, indicating potential market expansion.

- Unlock comprehensive insights into our analysis of Peijia Medical stock in this financial health report.

- Evaluate Peijia Medical's prospects by accessing our earnings growth report.

SanluxLtd (SZSE:002224)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sanlux Co., Ltd specializes in the research, development, production, and sales of rubber V-belts both in China and internationally, with a market cap of CN¥4.26 billion.

Operations: The company generates revenue of CN¥917.38 million from its construction industry segment.

Market Cap: CN¥4.26B

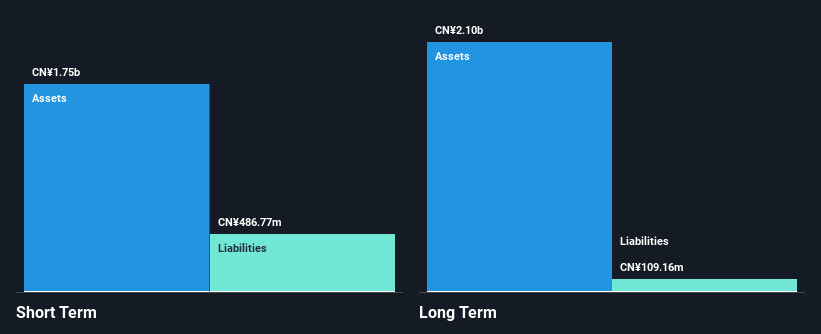

Sanlux Co., Ltd, with a market cap of CN¥4.26 billion, generates significant revenue from its construction industry segment (CN¥917.38 million). The company maintains more cash than total debt and has strong short-term asset coverage for both short and long-term liabilities. However, earnings have declined by 21.6% annually over the past five years, with current net profit margins at 4.8%, down from 7.2% last year, reflecting challenges in profitability despite high-quality earnings and stable weekly volatility (4%). Recent shareholder meetings focused on board elections suggest active governance engagement amidst these financial dynamics.

- Get an in-depth perspective on SanluxLtd's performance by reading our balance sheet health report here.

- Gain insights into SanluxLtd's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Discover the full array of 5,723 Global Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Town Health International Medical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10