ASX Growth Stocks With High Insider Ownership To Watch

The Australian market recently saw the ASX200 closing down by 0.48% at 7,749 points, with sectors like Staples and Discretionary leading the decline, while Real Estate managed a slight gain. In such fluctuating conditions, growth companies with high insider ownership can be appealing as they often indicate strong confidence from those closest to the business, which may be particularly valuable in navigating market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 40.9% |

| Gratifii (ASX:GTI) | 12.9% | 114.0% |

| Fenix Resources (ASX:FEX) | 21.1% | 45.1% |

| Acrux (ASX:ACR) | 15.6% | 106.9% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 16% | 108.2% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Change Financial (ASX:CCA) | 26.8% | 106.4% |

| Findi (ASX:FND) | 35.6% | 133.7% |

Click here to see the full list of 90 stocks from our Fast Growing ASX Companies With High Insider Ownership screener.

Let's review some notable picks from our screened stocks.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1.30 billion.

Operations: The company's revenue is primarily derived from its Healthcare Equipment segment, which generated A$183.97 million.

Insider Ownership: 15.3%

Nanosonics has demonstrated robust growth with its recent half-year earnings showing sales of A$93.6 million, up from A$79.64 million a year ago, and net income rising to A$9.76 million. The company revised its revenue guidance upward for early 2025, indicating strong momentum. Insider activity shows more buying than selling recently, suggesting confidence in future prospects. With forecasted earnings growth of 23.8% annually, Nanosonics is positioned well above the Australian market average of 12%.

- Get an in-depth perspective on Nanosonics' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Nanosonics' share price might be too optimistic.

Qualitas (ASX:QAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qualitas (ASX:QAL) is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt restructuring, third-party capital raisings, and consulting services, with a market cap of A$716.04 million.

Operations: Qualitas generates revenue through its Direct Lending segment, which accounts for A$23.03 million, and Funds Management, contributing A$21.46 million.

Insider Ownership: 28.5%

Qualitas has shown promising growth with half-year revenue rising to A$50.14 million from A$42.52 million, and net income increasing to A$16.28 million. Insider buying activity, though not substantial, indicates confidence in the company's future prospects. Earnings are forecasted to grow at 22.3% annually, outpacing the Australian market average of 12%, while revenue is expected to grow by 16.2% per year, although below the high-growth threshold of 20%.

- Click to explore a detailed breakdown of our findings in Qualitas' earnings growth report.

- The analysis detailed in our Qualitas valuation report hints at an inflated share price compared to its estimated value.

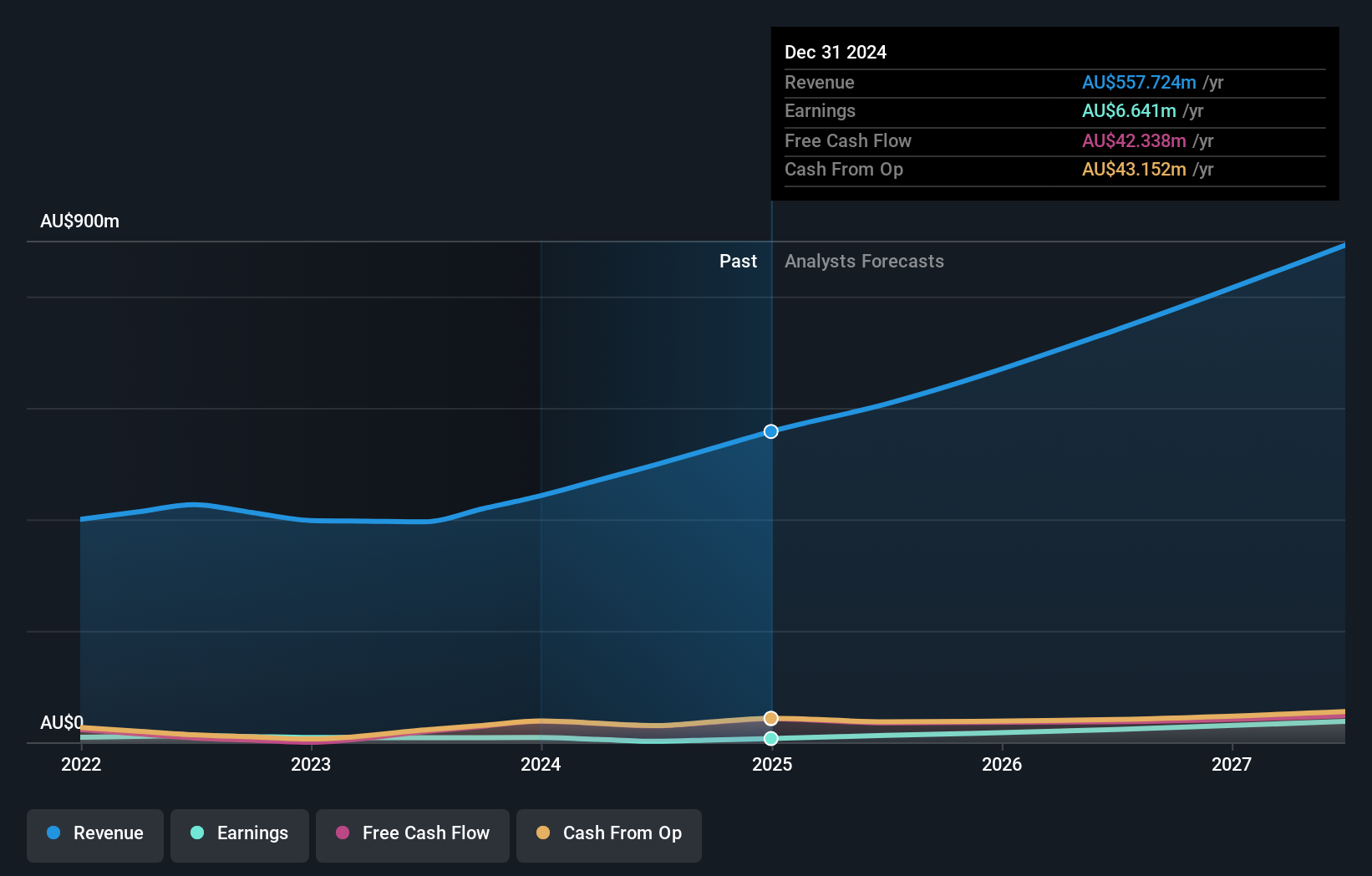

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd is an Australian company specializing in the online retail of furniture, homewares, and home improvement products, with a market capitalization of A$1.90 billion.

Operations: The company's revenue is primarily derived from the sale of furniture, homewares, and home improvement products, totaling A$557.72 million.

Insider Ownership: 12.3%

Temple & Webster Group has seen significant earnings growth, with net income doubling to A$8.98 million for the half-year ended December 2024. Despite a decline in profit margins from 1.9% to 1.2%, earnings are forecasted to grow at an impressive 39.5% annually, surpassing the Australian market average of 12%. Revenue is expected to increase by 16.5% annually, outperforming the market's growth rate of 5.8%. Insider trading activity over the past three months is not substantial.

- Delve into the full analysis future growth report here for a deeper understanding of Temple & Webster Group.

- Our valuation report unveils the possibility Temple & Webster Group's shares may be trading at a premium.

Next Steps

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 90 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10