W. R. Berkley (NYSE:WRB) Declares Quarterly Cash Dividend of US$0.08 Per Share

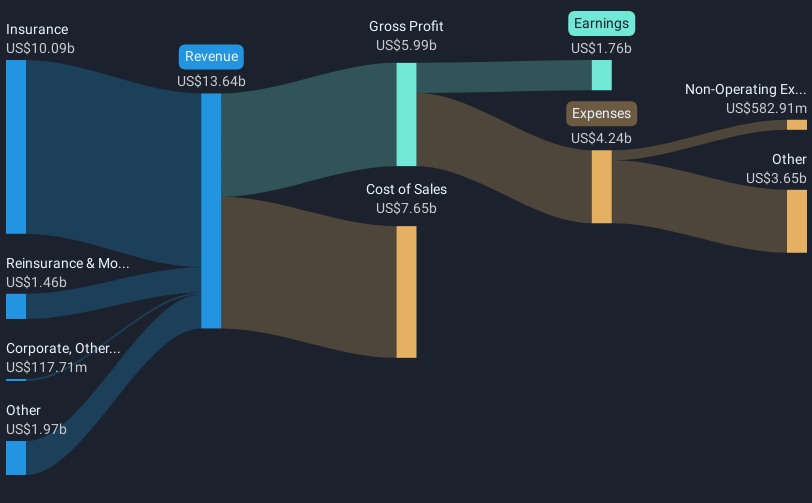

W. R. Berkley (NYSE:WRB) experienced a 7% increase in its share price over the last month, amidst a backdrop of contrasting market dynamics. The company's recent announcement of stable dividends and impressive fourth-quarter earnings, with revenue and net income both showing significant increases from the previous year, likely underpinned investor confidence. Additionally, the ongoing share buyback initiative may have positively influenced the share price by signaling the company's commitment to enhancing shareholder value. These favorable developments occurred as the broader market faced a decline, with major indexes like the Dow and Nasdaq posting losses in recent weeks. The resilience of WRB's stock price against the backdrop of a general market downturn illustrates investor confidence in the company's fundamentals and strategy, distinguishing it from broader market trends.

Take a closer look at W. R. Berkley's potential here.

Over the last five years, W. R. Berkley recorded a total return of 125.93%, a testament to the effective execution of its long-term strategy. This performance comes even as the company's earnings growth rate slightly lagged behind the broader U.S. market. A key element driving this return was consistent earnings growth, which improved profit margins from 11.4% to 12.9%. This is indicative of robust operational efficiency and strategic management.

Noteworthy also were strategic buyback initiatives, highlighted by a repurchase of over 1.16 million shares between October and December 2024, signaling a commitment to return value to shareholders. Additionally, a string of special cash dividends, including a $0.50 per share payout in September 2023, reinforced investor confidence and provided attractive yields. While recent market conditions presented challenges, the structure and execution of WRB’s capital allocation have significantly impacted its resilient stock performance.

- See how W. R. Berkley measures up with our analysis of its intrinsic value versus market price.

- Discover the key vulnerabilities in W. R. Berkley's business with our detailed risk assessment.

- Already own W. R. Berkley? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10