February 2025's Top Penny Stocks To Watch

Global markets have faced a turbulent week, with U.S. stocks ending lower amid tariff uncertainties and mixed economic signals, while Europe showed resilience with modest gains. In this climate, identifying promising investment opportunities requires careful consideration of financial strength and growth potential. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing possibilities for investors seeking value at lower price points.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.77B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.73B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £476.68M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.99 | £321.93M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR959.84M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR283.81M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Valuno Group (NGM:VALUNO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valuno Group AB (publ) is a fintech company based in Sweden with a market cap of approximately SEK515.13 million.

Operations: The company's revenue is primarily derived from its Solution for e-Merchants segment, which generated €159.80 million.

Market Cap: SEK515.13M

Valuno Group AB, a fintech company with a market cap of SEK515.13 million, recently rebranded from QuickBit eu AB and reported significant revenue growth in its e-Merchants segment, generating €159.80 million. Despite being unprofitable with losses increasing by 74.3% annually over the past five years, Valuno maintains a positive cash runway for over three years without debt concerns. Its short-term assets (€10.5M) fall short of covering liabilities (€12.8M), but the company benefits from reduced volatility and no recent shareholder dilution, though both management and board are relatively inexperienced with average tenures under two years.

- Click here and access our complete financial health analysis report to understand the dynamics of Valuno Group.

- Examine Valuno Group's past performance report to understand how it has performed in prior years.

New Focus Auto Tech Holdings (SEHK:360)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Focus Auto Tech Holdings Limited is an investment holding company that manufactures and sells electronic and power-related automotive parts and accessories across the People’s Republic of China, the Americas, Europe, and the Asia Pacific with a market cap of HK$860.85 million.

Operations: The company generates revenue from two main segments: CN¥410.94 million from its Manufacturing and Trading Business, and CN¥125.92 million from its Automobile Dealership and Service Business.

Market Cap: HK$860.85M

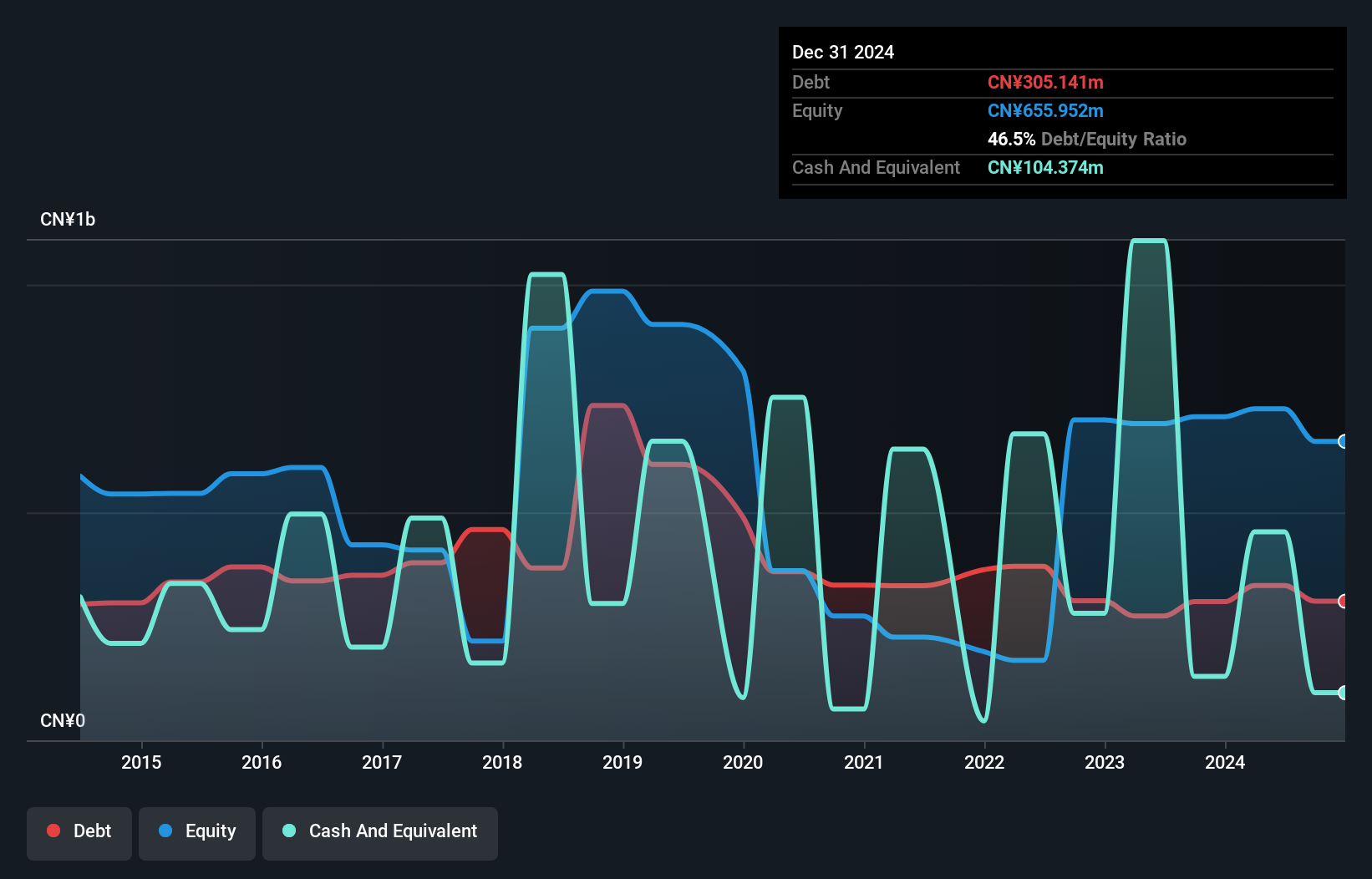

New Focus Auto Tech Holdings, with a market cap of HK$860.85 million, generates revenue primarily from its Manufacturing and Trading Business (CN¥410.94 million) and Automobile Dealership and Service Business (CN¥125.92 million). Despite being unprofitable with a negative return on equity (-13.65%), the company has reduced its debt to equity ratio over five years from 66.4% to 46.7%, maintaining more cash than total debt—a positive sign for financial stability among penny stocks. However, short-term assets (CN¥633.7M) do not cover short-term liabilities (CN¥700M), indicating potential liquidity challenges ahead despite reduced weekly volatility from 20% to 9%.

- Click here to discover the nuances of New Focus Auto Tech Holdings with our detailed analytical financial health report.

- Learn about New Focus Auto Tech Holdings' historical performance here.

Archosaur Games (SEHK:9990)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archosaur Games Inc. is an investment holding company that develops and operates mobile games in Mainland China and internationally, with a market cap of HK$1.13 billion.

Operations: The company's revenue is primarily derived from its Computer Graphics segment, totaling CN¥945.67 million.

Market Cap: HK$1.13B

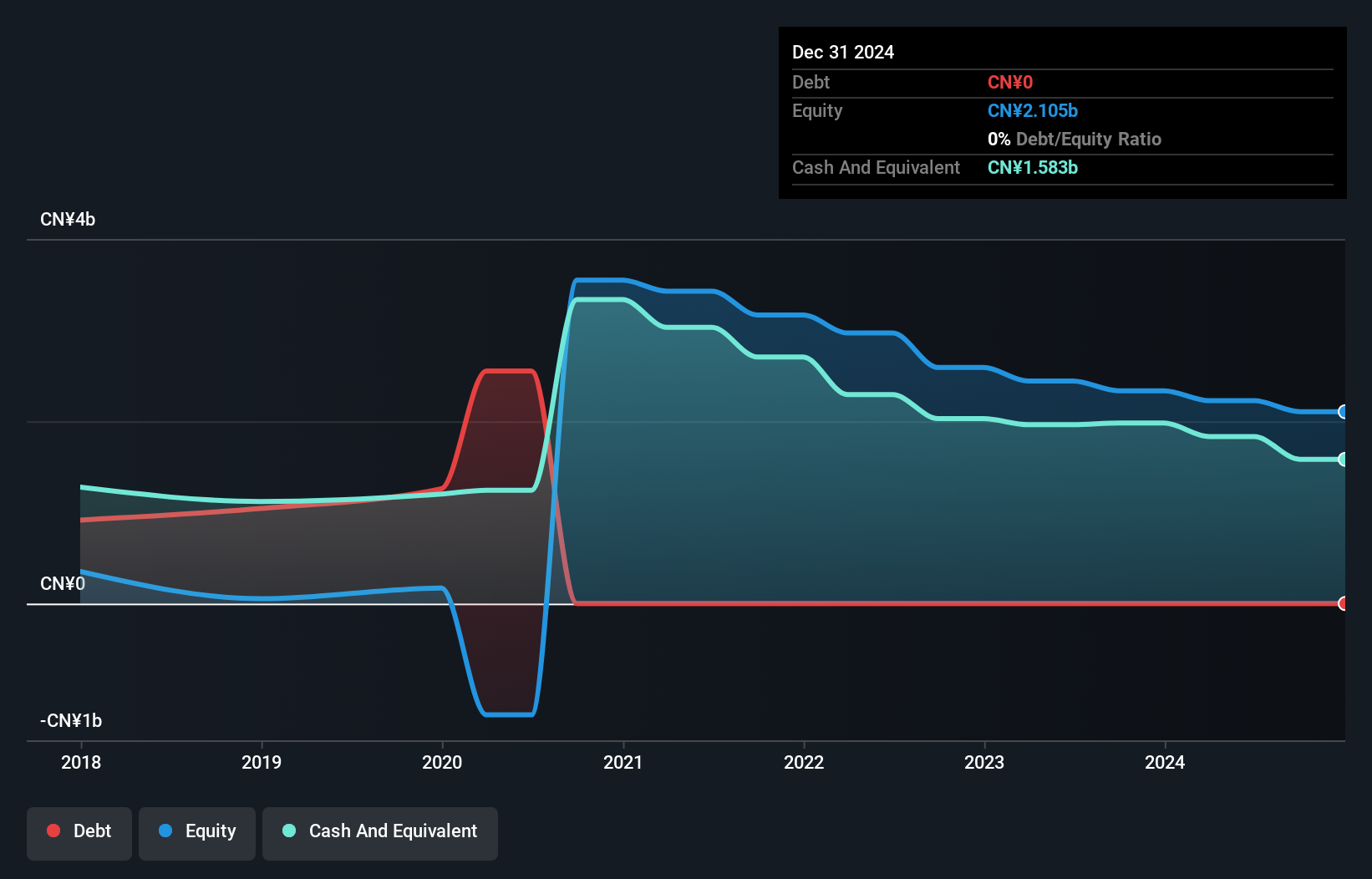

Archosaur Games, with a market cap of HK$1.13 billion, focuses on mobile game development and is currently unprofitable. Despite its financial challenges, the company benefits from having no debt and sufficient cash runway to support operations for over three years. The board and management team are experienced, with average tenures of 4.7 and 4.6 years respectively, which may provide stability in navigating the competitive gaming industry. Although revenue is projected to grow by 26.35% annually, profitability remains elusive in the near term as losses have increased at a rate of 7.7% per year over five years.

- Unlock comprehensive insights into our analysis of Archosaur Games stock in this financial health report.

- Examine Archosaur Games' earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Take a closer look at our Penny Stocks list of 5,705 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10