John Hussman Reduces Stake in Barrick Gold Corp by 68%, Impacting Portfolio by -2.11%

Insight into John Hussman (Trades, Portfolio)'s Strategic Moves in Q4 2024

John Hussman (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2024, providing insights into his investment moves during this period. Dr. John Hussman (Trades, Portfolio) is the president and principal shareholder of Hussman Strategic Advisors, the investment advisory firm that manages the Hussman Funds. He is also the president of the Hussman Investment Trust. Dr. Hussman manages the Hussman Strategic Growth Fund, which invests primarily in U.S. stocks, and the Hussman Strategic Total Return Fund, which invests primarily in U.S. Treasury and government agency securities. Prior to managing the Hussman Funds, Dr. Hussman was a professor of economics and international finance at the University of Michigan. His academic research centers on market efficiency and information economics. Dr. Hussman holds a Ph.D. in economics from Stanford University (1992) and two degrees from Northwestern University: a Master's degree in education and social policy (1985) and a Bachelor's degree in economics (1983). Dr. Hussman looks at two dimensions of information to adjust his willingness to take risk. The first is valuation. Favorable valuation means that stock prices appear reasonable in view of the stream of earnings, dividends, revenues and cash flows expected in the future. The second dimension is the quality of market action. Market action considers the behavior of a wide range of securities and industry groups in an attempt to assess the economic outlook of investors and their willingness to accept market risk. These two dimensions of information make up four basic "Market Climates" associated with various combinations of valuation and market action. In the most favorable Market Climates, Dr. Hussman will typically hold an aggressive allocation to market risk, while in the least favorable Market Climates, he will typically attempt to remove the impact of market fluctuations from the portfolio through hedging (Strategic Growth Fund) or reduction in the average maturity of bond holdings (Strategic Total Return Fund). The most defensive position is a fully hedged position in which the entire value of long positions is hedged.

Summary of New Buy

John Hussman (Trades, Portfolio) added a total of 102 stocks, among them:

- The most significant addition was Protagonist Therapeutics Inc (PTGX, Financial), with 105,000 shares, accounting for 1.2% of the portfolio and a total value of $4,053,000.

- The second largest addition to the portfolio was Incyte Corp (INCY, Financial), consisting of 42,000 shares, representing approximately 0.86% of the portfolio, with a total value of $2,900,940.

- The third largest addition was The Cigna Group (CI, Financial), with 10,500 shares, accounting for 0.86% of the portfolio and a total value of $2,899,470.

Key Position Increases

John Hussman (Trades, Portfolio) also increased stakes in a total of 37 stocks, among them:

- The most notable increase was Colgate-Palmolive Co (CL, Financial), with an additional 42,000 shares, bringing the total to 67,200 shares. This adjustment represents a significant 166.67% increase in share count, a 1.13% impact on the current portfolio, with a total value of $6,109,150.

- The second largest increase was The Campbell's Co (CPB, Financial), with an additional 84,000 shares, bringing the total to 147,000. This adjustment represents a significant 133.33% increase in share count, with a total value of $6,156,360.

Summary of Sold Out

John Hussman (Trades, Portfolio) completely exited 84 holdings in the fourth quarter of 2024, as detailed below:

- Buckle Inc (BKE, Financial): John Hussman (Trades, Portfolio) sold all 84,000 shares, resulting in a -0.91% impact on the portfolio.

- Intel Corp (INTC, Financial): John Hussman (Trades, Portfolio) liquidated all 147,000 shares, causing a -0.85% impact on the portfolio.

Key Position Reduces

John Hussman (Trades, Portfolio) also reduced positions in 46 stocks. The most significant changes include:

- Reduced Barrick Gold Corp (GOLD, Financial) by 433,500 shares, resulting in a -68% decrease in shares and a -2.11% impact on the portfolio. The stock traded at an average price of $18.15 during the quarter and has returned -12.49% over the past 3 months and 6.94% year-to-date.

- Reduced Agnico Eagle Mines Ltd (AEM, Financial) by 102,000 shares, resulting in a -80% reduction in shares and a -2.02% impact on the portfolio. The stock traded at an average price of $82.45 during the quarter and has returned 12.13% over the past 3 months and 22.43% year-to-date.

Portfolio Overview

At the fourth quarter of 2024, John Hussman (Trades, Portfolio)'s portfolio included 234 stocks, with top holdings including 1.82% in The Campbell's Co (CPB, Financial), 1.8% in Colgate-Palmolive Co (CL, Financial), 1.74% in Verizon Communications Inc (VZ, Financial), 1.6% in Novo Nordisk AS (NVO, Financial), and 1.44% in NRG Energy Inc (NRG, Financial).

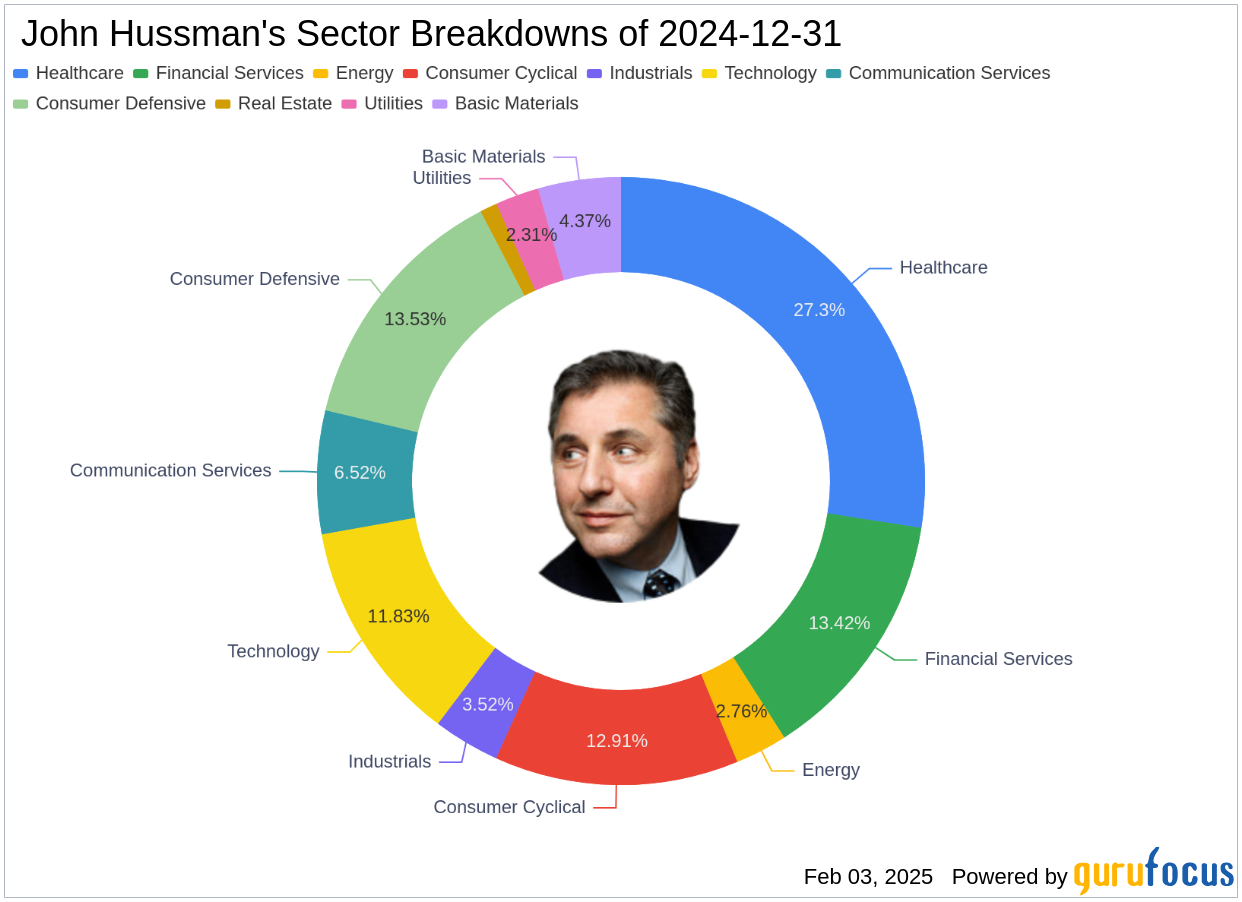

The holdings are mainly concentrated in all 11 industries: Healthcare, Consumer Defensive, Financial Services, Consumer Cyclical, Technology, Communication Services, Basic Materials, Industrials, Energy, Utilities, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10