Spotlight On Huationg Global And Two Other Prominent Penny Stocks

Global markets have been buoyed by recent political developments and economic indicators, with U.S. stocks reaching record highs amid optimism over potential trade deals and AI investment initiatives. In such a climate, investors often seek opportunities that balance affordability with growth potential, making penny stocks an intriguing area of focus. While the term 'penny stocks' may seem outdated, these investments in smaller or newer companies can still offer value when supported by strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.71 | HK$42.65B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Huationg Global (Catalist:41B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Huationg Global Limited is an investment holding company that offers civil engineering services for infrastructure projects mainly in Singapore, with a market cap of SGD38.11 million.

Operations: The company's revenue is primarily derived from Civil Engineering Contract Works at SGD153.68 million, followed by Dormitory Operation at SGD41.09 million, Inland Logistics Support at SGD29.01 million, and the Sale of Construction Materials at SGD13.48 million.

Market Cap: SGD38.11M

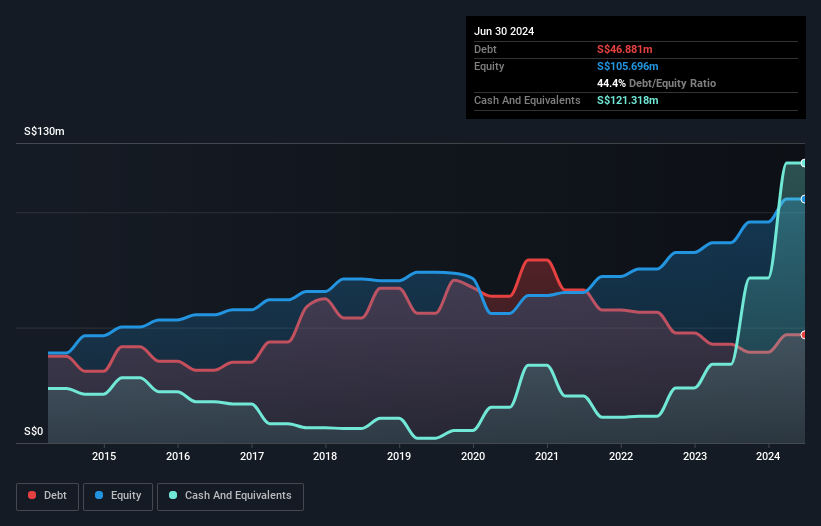

Huationg Global Limited, with a market cap of SGD38.11 million, shows promising financial metrics for investors considering penny stocks. The company's earnings have grown significantly by 64.2% over the past year, outpacing its five-year average and the broader construction industry growth rate. Its debt is well covered by operating cash flow, and it has more cash than total debt, indicating strong financial health. However, the share price has been highly volatile recently. Despite a low return on equity at 18.9%, Huationg's high-quality earnings and experienced management team provide a solid foundation for potential growth.

- Click here to discover the nuances of Huationg Global with our detailed analytical financial health report.

- Gain insights into Huationg Global's historical outcomes by reviewing our past performance report.

Trigiant Group (SEHK:1300)

Simply Wall St Financial Health Rating: ★★★★☆☆

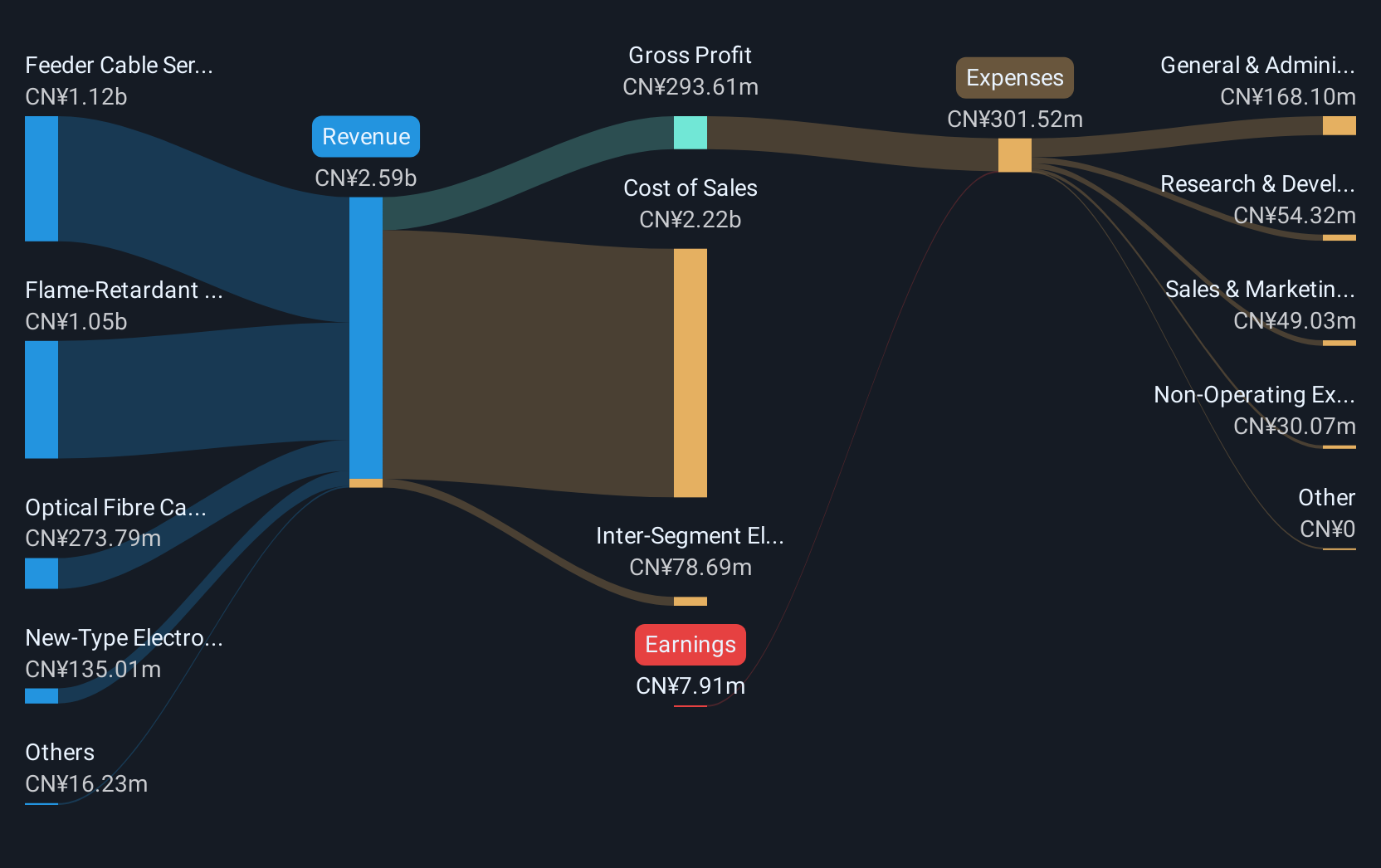

Overview: Trigiant Group Limited is an investment holding company that manufactures and sells feeder cables, optical fiber cables, flame-retardant flexible cables, and related products for mobile communications and telecommunication equipment in the People's Republic of China, with a market cap of HK$597.72 million.

Operations: The company generates its revenue from several segments, including CN¥1.10 billion from the Feeder Cable Series, CN¥961.90 million from the Flame-Retardant Flexible Cable Series, CN¥256.16 million from Optical Fibre Cable Series and Related Products, and CN¥146.36 million from New-Type Electronic Components.

Market Cap: HK$597.72M

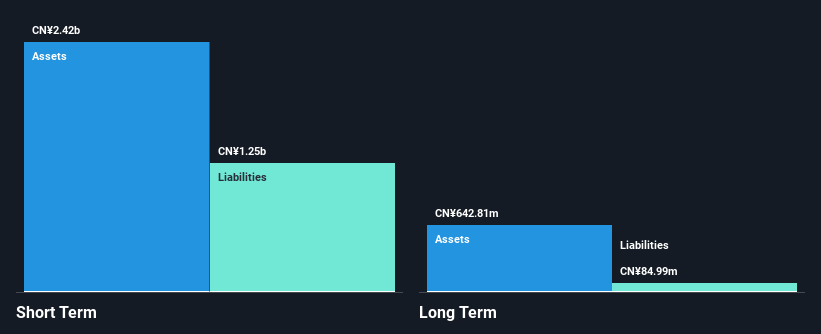

Trigiant Group Limited, with a market cap of HK$597.72 million, has robust short-term assets (CN¥5.1 billion) that exceed both its short and long-term liabilities, indicating solid liquidity. Despite an increase in the debt to equity ratio over five years to 46.1%, the net debt to equity remains satisfactory at 29.5%. The company is currently unprofitable with declining earnings, but recent share repurchase plans could enhance net asset value per share and earnings per share. Management's seasoned experience contrasts with a relatively inexperienced board, suggesting potential strategic shifts ahead.

- Dive into the specifics of Trigiant Group here with our thorough balance sheet health report.

- Evaluate Trigiant Group's historical performance by accessing our past performance report.

ClouDr Group (SEHK:9955)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ClouDr Group Limited is an investment holding company that offers SaaS solutions to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for chronic condition management, with a market cap of HK$751.41 million.

Operations: The company generates revenue from its Wholesale - Drugs segment, amounting to CN¥4.01 billion.

Market Cap: HK$751.41M

ClouDr Group Limited, with a market cap of HK$751.41 million, is navigating financial challenges as it remains unprofitable, though it has reduced losses by 35.2% annually over the past five years. The company's short-term assets (CN¥2.4 billion) comfortably cover both its short and long-term liabilities, highlighting strong liquidity. Despite having a relatively inexperienced board and management team, ClouDr's cash runway is sufficient for over a year even if free cash flow continues to decline slightly. Trading at good value compared to peers in the healthcare sector, its revenue from drug wholesale is significant at CN¥4.01 billion annually.

- Unlock comprehensive insights into our analysis of ClouDr Group stock in this financial health report.

- Gain insights into ClouDr Group's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Embark on your investment journey to our 5,714 Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huationg Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10