CSPC Pharmaceutical Group And 2 Other Penny Stocks To Watch This Year

Global markets have shown resilience, with major U.S. stock indexes rebounding and European stocks rising sharply amidst easing inflation concerns, while Japan's markets faced a downturn due to potential interest rate hikes. In such a fluctuating economic landscape, identifying stocks with solid financial foundations becomes crucial for investors seeking growth opportunities. Penny stocks, although an older term, remain relevant as they often represent smaller or newer companies that can offer affordability and potential for substantial returns when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.67 | £418.56M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.56 | THB1.99B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,701 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

CSPC Pharmaceutical Group (SEHK:1093)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CSPC Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical products across China and internationally, with a market cap of HK$50.61 billion.

Operations: The company's revenue is primarily derived from Finished Drugs, generating CN¥24.97 billion, along with contributions from Bulk Products - Vitamin C at CN¥1.91 billion, Functional Food and Others at CN¥2.02 billion, and Bulk Products - Antibiotics at CN¥1.82 billion.

Market Cap: HK$50.61B

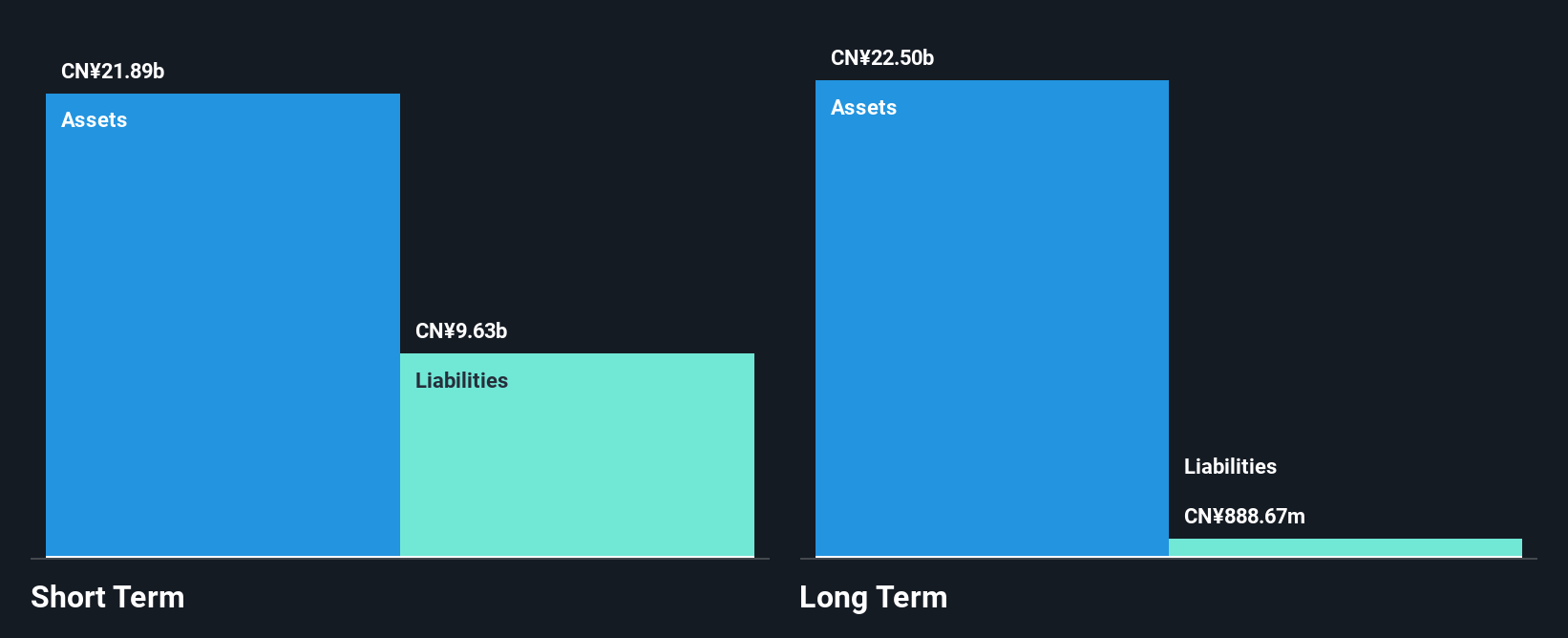

CSPC Pharmaceutical Group, with a market cap of HK$50.61 billion, has been actively expanding its R&D efforts despite recent revenue challenges due to declining caffeine prices and health food sales. The company reported significant progress in product development, including marketing approvals for Enlonstobart Injection and Omalizumab for Injection. CSPC's financials show a robust balance sheet with short-term assets exceeding liabilities and debt well-covered by operating cash flow. However, the management team is relatively new, which may impact strategic execution. Recent guidance indicates expected net profit between CN¥450 million to CN¥660 million for 2024 amidst increased R&D investments.

- Get an in-depth perspective on CSPC Pharmaceutical Group's performance by reading our balance sheet health report here.

- Examine CSPC Pharmaceutical Group's earnings growth report to understand how analysts expect it to perform.

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited is an investment holding company that operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in the People's Republic of China, with a market cap of approximately HK$4.38 billion.

Operations: The company generates revenue primarily from Passenger Vehicle Sales and Services, amounting to CN¥67.59 billion, and Automobile Operating Lease Services, contributing CN¥448.73 million.

Market Cap: HK$4.38B

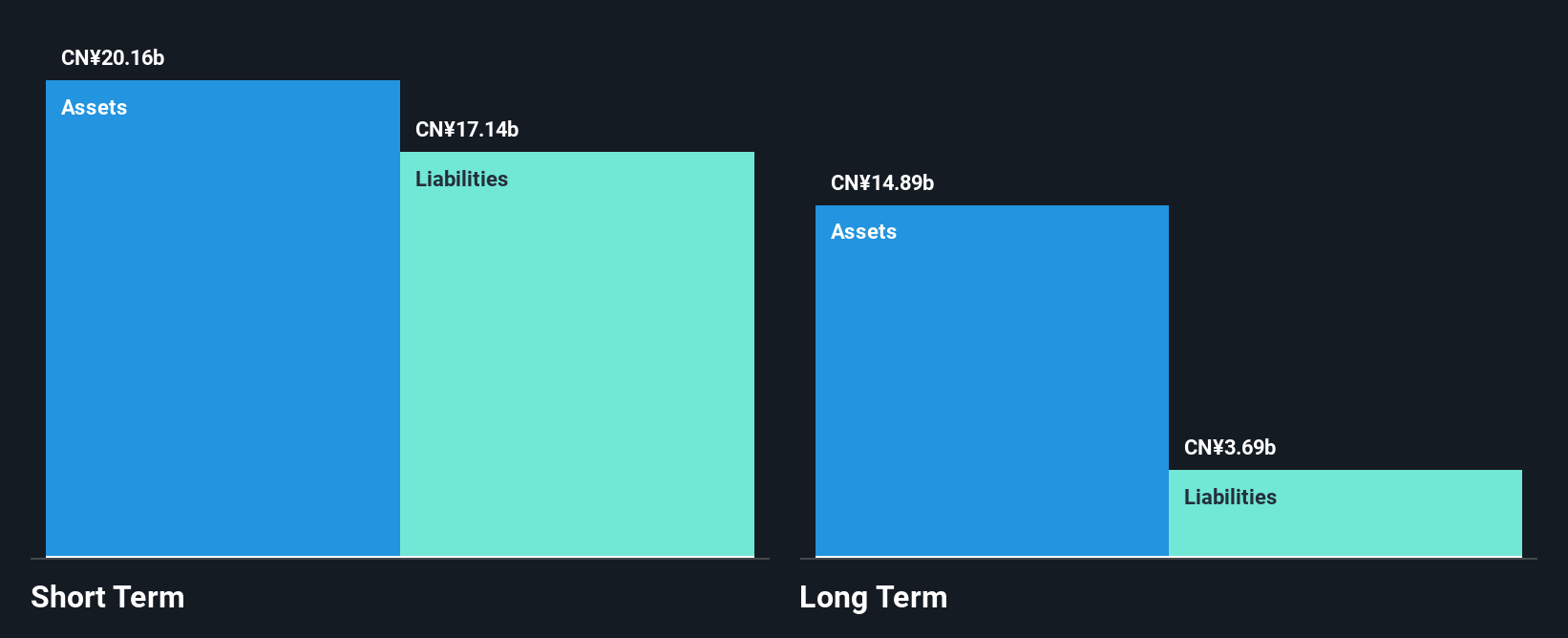

China Yongda Automobiles Services Holdings, with a market cap of approximately HK$4.38 billion, operates in the luxury vehicle sector in China. Despite stable weekly volatility over the past year, its share price remains highly volatile. The company's net profit margins have declined from 1.5% to 0.4%, and earnings growth has been negative, contrasting with industry trends. However, its debt is well-managed with a satisfactory net debt to equity ratio of 12.1%, and short-term assets comfortably cover both short- and long-term liabilities. While trading significantly below estimated fair value, interest coverage remains inadequate at 1.7x EBIT.

- Jump into the full analysis health report here for a deeper understanding of China Yongda Automobiles Services Holdings.

- Assess China Yongda Automobiles Services Holdings' future earnings estimates with our detailed growth reports.

Xiwang FoodstuffsLtd (SZSE:000639)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xiwang Foodstuffs Co., Ltd., with a market cap of CN¥3.77 billion, operates in China focusing on the research, development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥3.77B

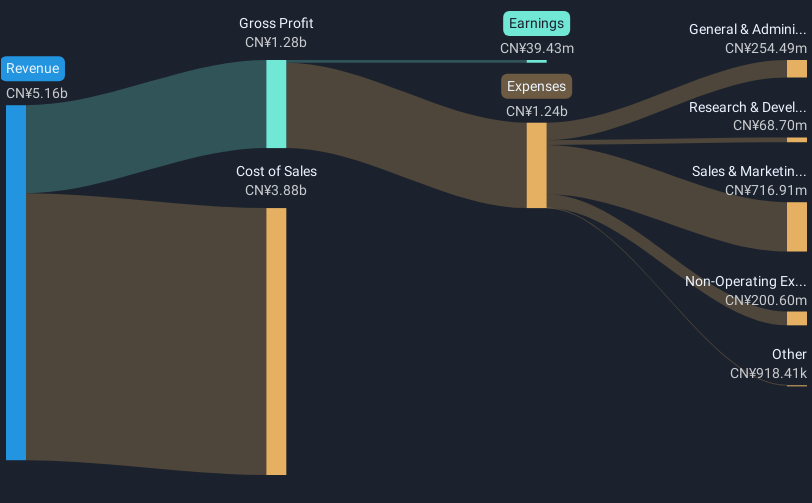

Xiwang Foodstuffs Co., Ltd. has recently completed an acquisition of a minority stake valued at CN¥190 million, potentially impacting its capital structure. The company reported nine-month sales of CN¥3.81 billion, with net income rising significantly to CN¥62.59 million from the previous year. Despite this profitability, its share price remains highly volatile and trades well below estimated fair value. Although short-term assets exceed liabilities, interest coverage is weak at 2.1x EBIT due to large one-off losses affecting earnings quality. Management and board experience are strong, yet return on equity remains low at 0.5%.

- Click here to discover the nuances of Xiwang FoodstuffsLtd with our detailed analytical financial health report.

- Examine Xiwang FoodstuffsLtd's past performance report to understand how it has performed in prior years.

Next Steps

- Access the full spectrum of 5,701 Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10