Hedera’s $4 Million Inflows Ignite Rally Speculation Amid Mixed Market Signals

- Hedera's token has recorded its first inflows in a week, signaling renewed demand despite recent outflows.

- TSI and MACD signals highlight ongoing selling pressure, suggesting risks of further price declines.

- HBAR trades near $0.28, but depending on market sentiment, it could drop to $0.24 or rally to $0.33.

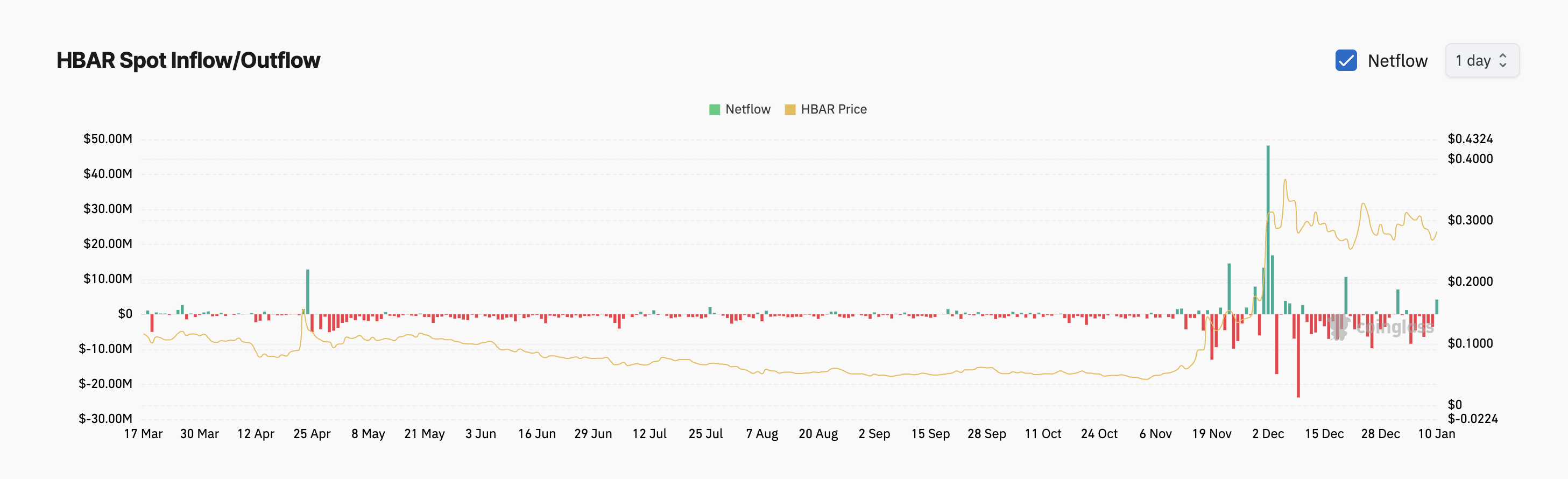

HBAR, the native token powering the Hedera Hashgraph distributed ledger, has recorded its first spot inflows in the past week, totaling $4 million. This has sparked speculation that this could mean the altcoin is poised to break above the narrow range it has traded within since early December.

However, bearish pressure persists, putting HBAR’s price at risk of remaining rangebound or even witnessing a drop.

Hedera Records Spot Inflows, But There Is a Catch

According to Coinglass, HBAR’s spot inflows have reached $4 million on Friday. This comes after six consecutive days of fund outflows totaling $26 million.

When an asset experiences spot inflows, it means that there is an increase in the purchase of that asset in the spot market, where transactions are settled immediately. This indicates a rise in demand for the asset, as buyers are willing to acquire it at the current market price.

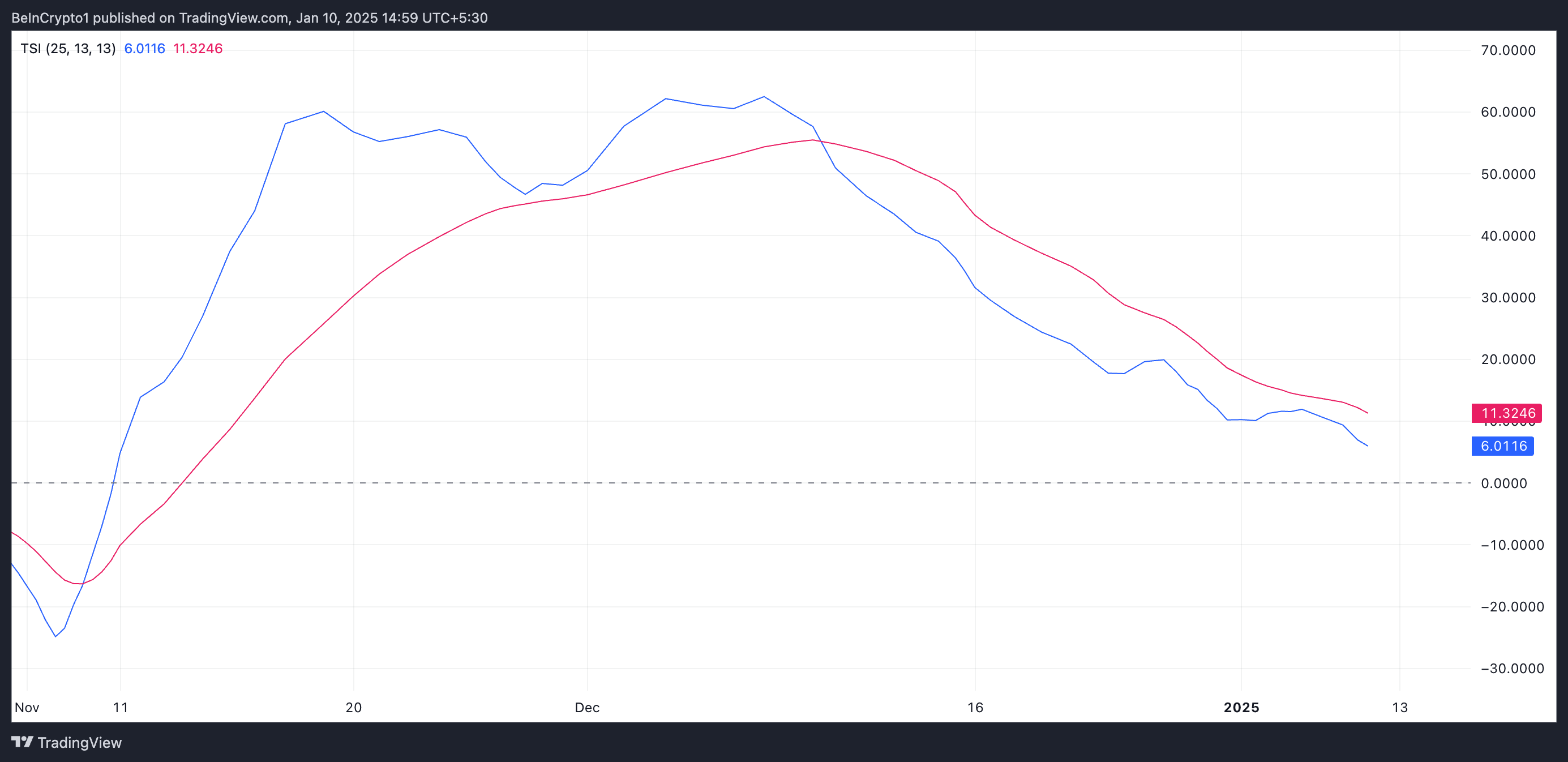

However, while HBAR’s spot inflow is a positive sign, its technical indicators suggest that bearish pressure remains. For example, readings from its True Strength Index (TSI) indicator show the TSI line (blue) below the signal line (red) at press time, reflecting the strengthening bearish bias.

The TSI indicator helps identify the strength and direction of a trend by smoothing price movements. When the TSI line is below the signal line, it indicates bearish momentum. This suggests that selling pressure is stronger than buying interest.

Moreso, traders interpret this crossover as a sell signal or a warning that the upward trend is weakening and that further downward movement might be ahead.

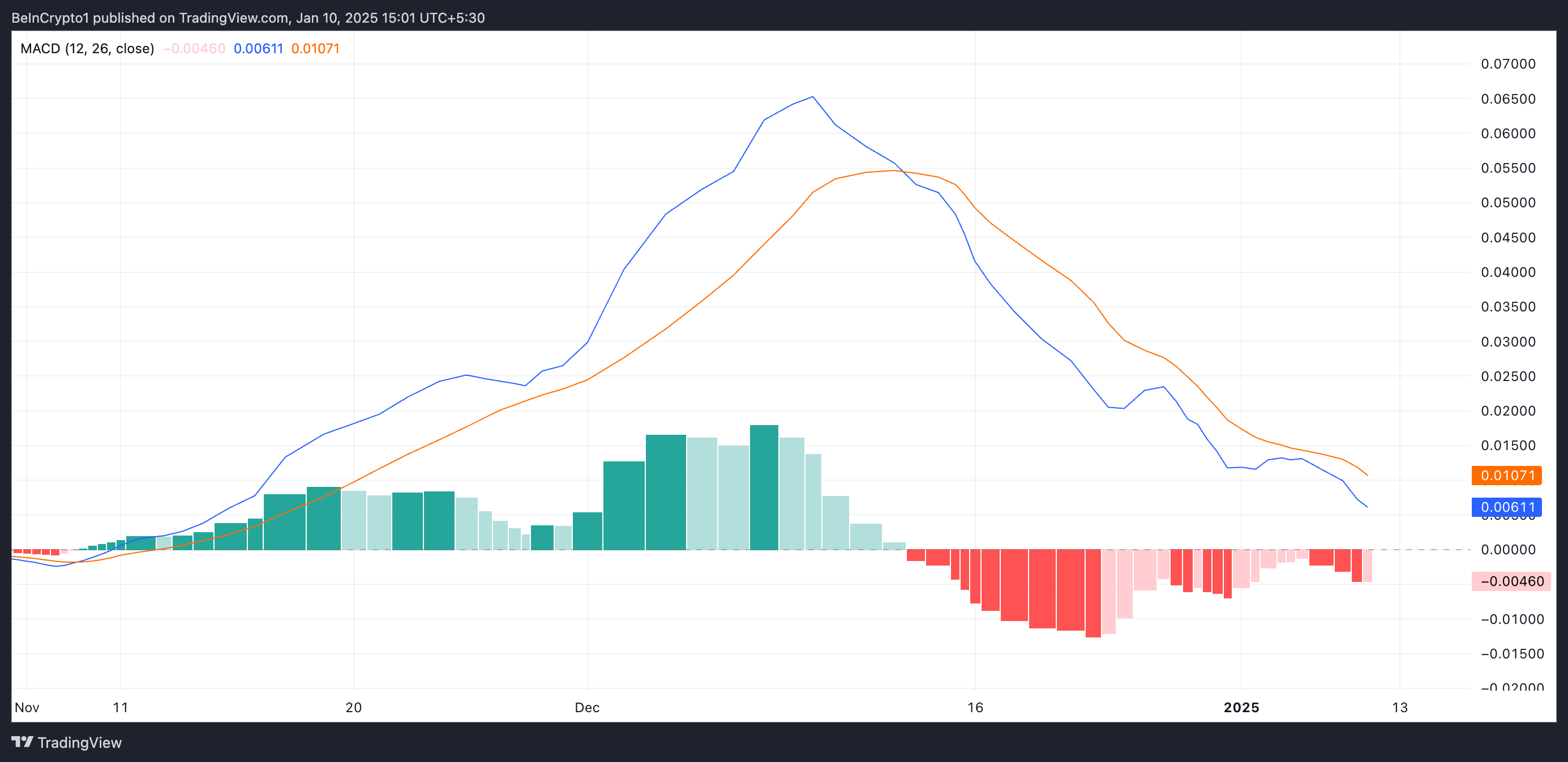

HBAR’s Moving Average Convergence Divergence (MACD) indicator also supports this bearish outlook. At press time, the token’s MACD line (blue) rests below its signal line (orange).

When this indicator is set up this way, it indicates bearish momentum. This means that selloffs exceed buying activity among market participants, putting significant downward pressure on its price.

HBAR Price Prediction: Time to Break Out of This Range?

Since December 4, HBAR’s price has oscillated between a price range. It has faced resistance at $0.33 and found support at $0.24. As of this writing, the altcoin trades just above this support level at $0.28.

With the increasing downward pressure on its price, it may fall to test this support. Should it fail to hold, its value could plunge further to $0.16.

Conversely, if inflows into the token’s spot market continue due to sustained demand for the altcoin, HBAR’s price could rise to $0.33.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10