Undervalued Opportunities: Penny Stocks To Consider In January 2025

Global markets have shown mixed performance as we enter 2025, with U.S. stocks closing a strong year despite recent volatility and profit-taking. Amidst these broader market movements, investors often explore smaller opportunities that may not be immediately apparent in larger indices. Penny stocks, although an outdated term, continue to attract attention due to their potential for growth when backed by solid financials. This article will explore several penny stocks that stand out for their financial strength and potential value in the current market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.984 | £747.6M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.70 | HK$40.74B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £471.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.47 | £66.18M | ★★★★☆☆ |

Click here to see the full list of 5,821 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Arbona (NGM:ARBO A)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arbona AB (publ) is an investment company that focuses on small and medium-sized listed and unlisted companies in Sweden, with a market cap of SEK1.66 billion.

Operations: The company generates SEK218.13 million in revenue from its operations in Sweden.

Market Cap: SEK1.66B

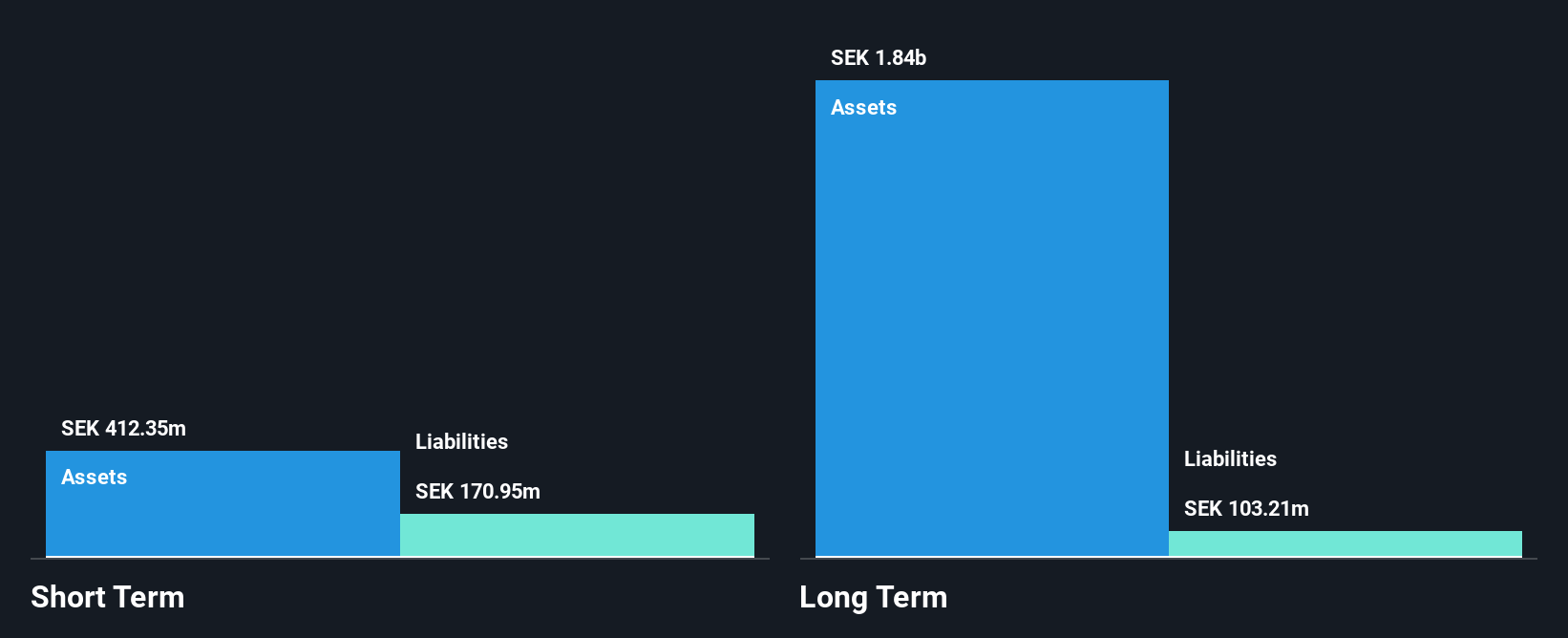

Arbona AB, with a market cap of SEK1.66 billion, demonstrates solid financial health and growth potential. Its short-term assets of SEK451.4 million comfortably cover both short- and long-term liabilities, indicating strong liquidity. The company's earnings have grown significantly by 201.3% over the past year, outpacing the industry average and reflecting robust performance despite lower net profit margins compared to last year. Arbona's Return on Equity stands at a high 21.9%, supported by more cash than total debt and reduced debt-to-equity ratio over five years, suggesting prudent financial management without shareholder dilution in the past year.

- Dive into the specifics of Arbona here with our thorough balance sheet health report.

- Examine Arbona's past performance report to understand how it has performed in prior years.

Shanghai Gench Education Group (SEHK:1525)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai Gench Education Group Limited is an investment holding company that offers higher education services in the People’s Republic of China, with a market cap of approximately HK$1.17 billion.

Operations: The company generates revenue primarily from its higher education services, amounting to CN¥971.08 million.

Market Cap: HK$1.17B

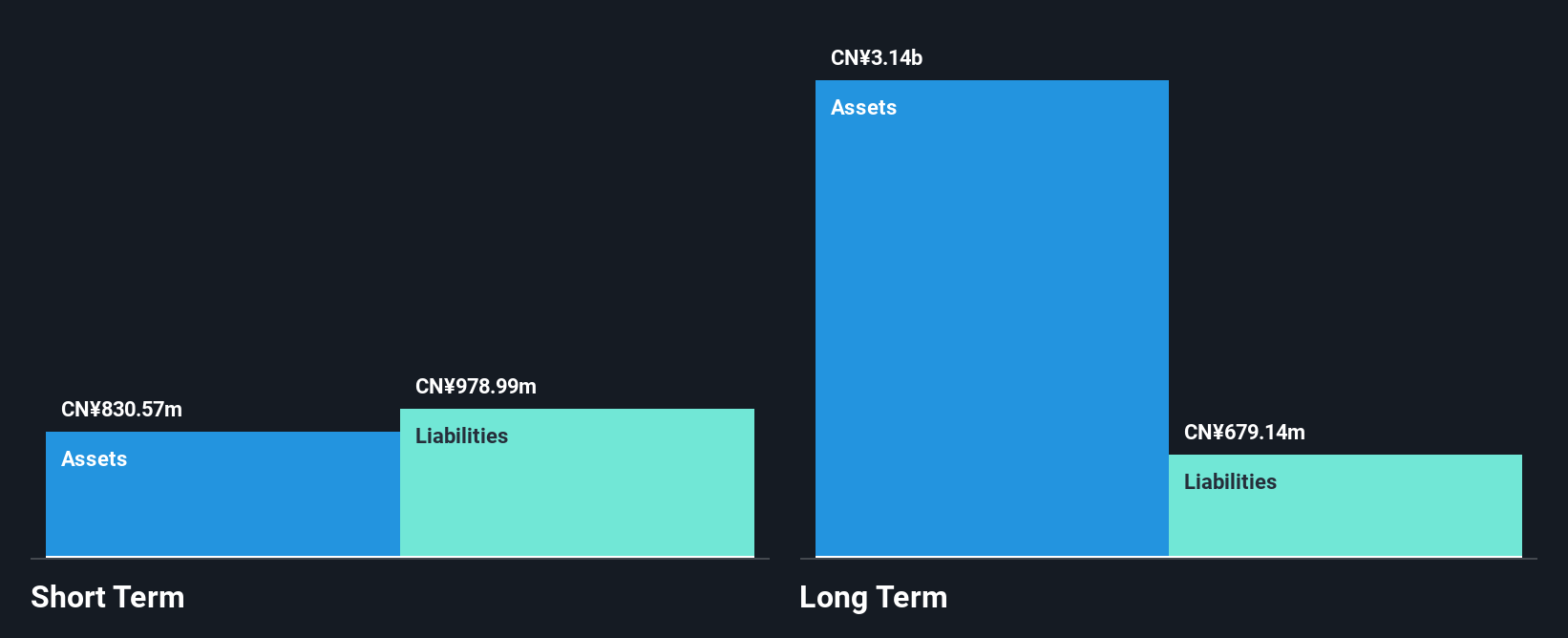

Shanghai Gench Education Group, with a market cap of HK$1.17 billion, shows a mixed financial picture typical of penny stocks. Its earnings have grown by 16.1% annually over the past five years, though recent growth slowed to 1.6%, trailing the industry average. The company's Return on Equity is low at 12.1%, but its debt management appears prudent with interest payments well-covered by EBIT and operating cash flow covering 47% of its debt. Despite high-quality earnings and stable weekly volatility, short-term assets fall short in covering long-term liabilities, highlighting potential liquidity challenges ahead.

- Unlock comprehensive insights into our analysis of Shanghai Gench Education Group stock in this financial health report.

- Gain insights into Shanghai Gench Education Group's past trends and performance with our report on the company's historical track record.

New JCM GroupLtd (SZSE:300157)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New JCM Group Co., Ltd, along with its subsidiaries, operates in the equipment manufacturing sector both in China and internationally, with a market capitalization of approximately CN¥2.10 billion.

Operations: Currently, there are no specific revenue segments reported for this company.

Market Cap: CN¥2.1B

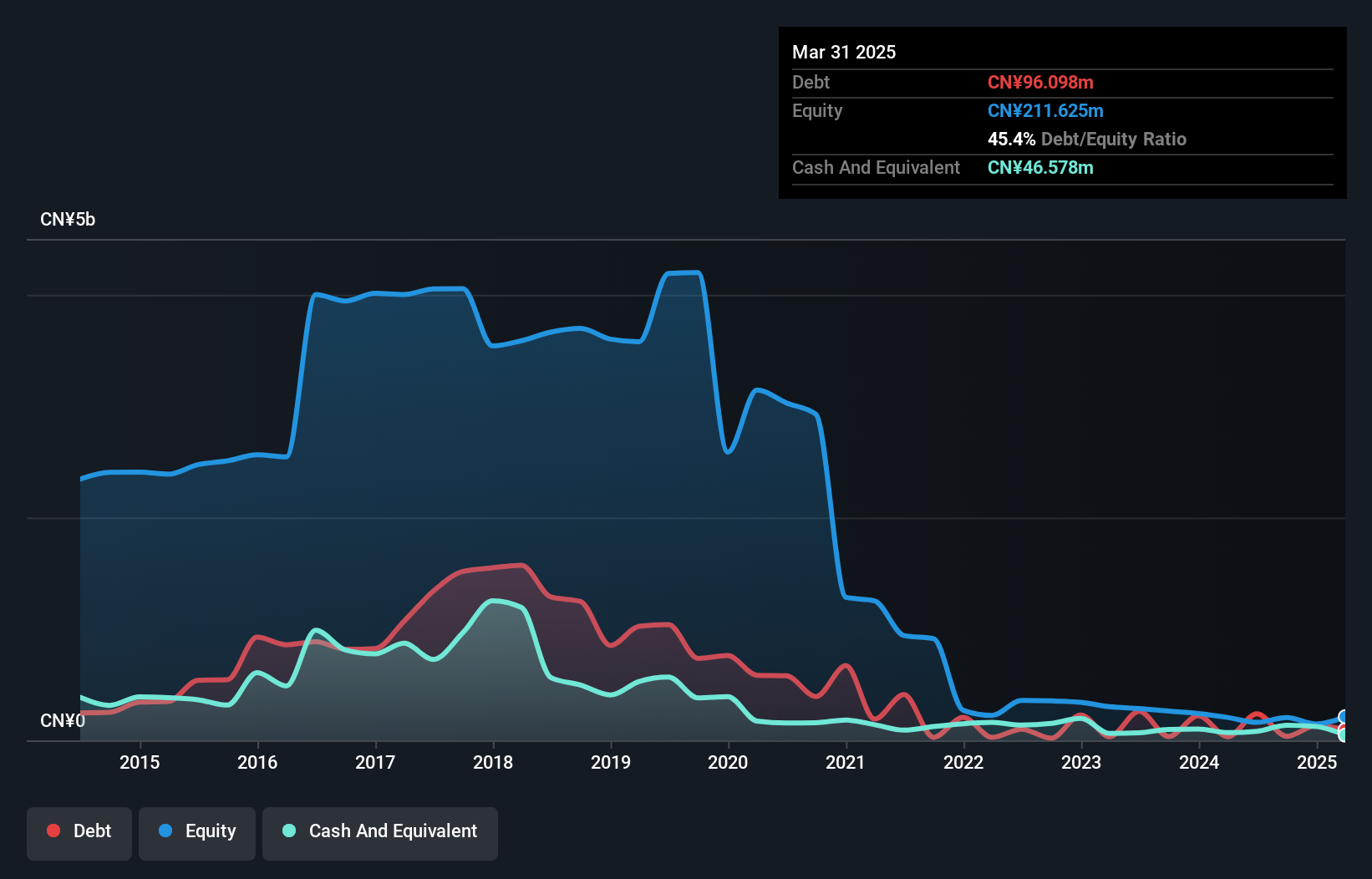

New JCM Group Co., Ltd, with a market cap of CN¥2.10 billion, presents a complex financial landscape. Despite being unprofitable, it has reduced losses by 35.8% annually over the past five years and maintains more cash than total debt, indicating prudent financial management. However, its short-term assets (CN¥1.2 billion) fall short of covering short-term liabilities (CN¥1.8 billion), posing liquidity concerns despite long-term liabilities being covered. The company reported sales of CN¥390.8 million for the nine months ending September 2024 but experienced a net loss increase to CN¥109.17 million from the previous year’s CNY 92 million loss.

- Navigate through the intricacies of New JCM GroupLtd with our comprehensive balance sheet health report here.

- Assess New JCM GroupLtd's previous results with our detailed historical performance reports.

Taking Advantage

- Dive into all 5,821 of the Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10