3 Compelling Penny Stocks With Over US$60M Market Cap

Global markets have experienced turbulence recently, with U.S. stocks declining amid cautious commentary from the Federal Reserve and political uncertainties surrounding a potential government shutdown. Despite these challenges, certain investment opportunities continue to attract attention, particularly in the realm of penny stocks. Although the term 'penny stock' might seem outdated, these smaller or newer companies can offer significant growth potential when supported by strong financials. In this article, we explore three such penny stocks that stand out for their financial strength and promise as under-the-radar investments poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £145.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.39 | £64.65M | ★★★★☆☆ |

Click here to see the full list of 5,826 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Phoenix Group Plc operates in the development, operation, and management of crypto mining and data centers across the United Arab Emirates, Oman, Canada, and the United States with a market capitalization of AED7.50 billion.

Operations: The company generates revenue of $214.72 million from its data processing segment.

Market Cap: AED7.5B

Phoenix Group's recent executive change, with Munaf Ali stepping in as CEO, signals a strategic shift toward leveraging opportunities in the cryptocurrency and blockchain sectors. Despite a volatile share price and declining revenue by 47.1% over the past year, Phoenix maintains a strong Return on Equity at 26.6%, indicating efficient use of equity capital. The company's short-term assets significantly exceed both its long-term and short-term liabilities, suggesting solid liquidity management. However, negative operating cash flow raises concerns about debt coverage despite high profit margins and satisfactory net debt to equity ratio of 1.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Phoenix Group.

- Gain insights into Phoenix Group's future direction by reviewing our growth report.

Green Cross Health (NZSE:GXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Green Cross Health Limited operates as a provider of healthcare and advisory services across communities in New Zealand, with a market capitalization of NZ$114.88 million.

Operations: The company's revenue is derived from Medical Services, contributing NZ$149.29 million, and Pharmacy Services, which accounts for NZ$364.32 million.

Market Cap: NZ$114.88M

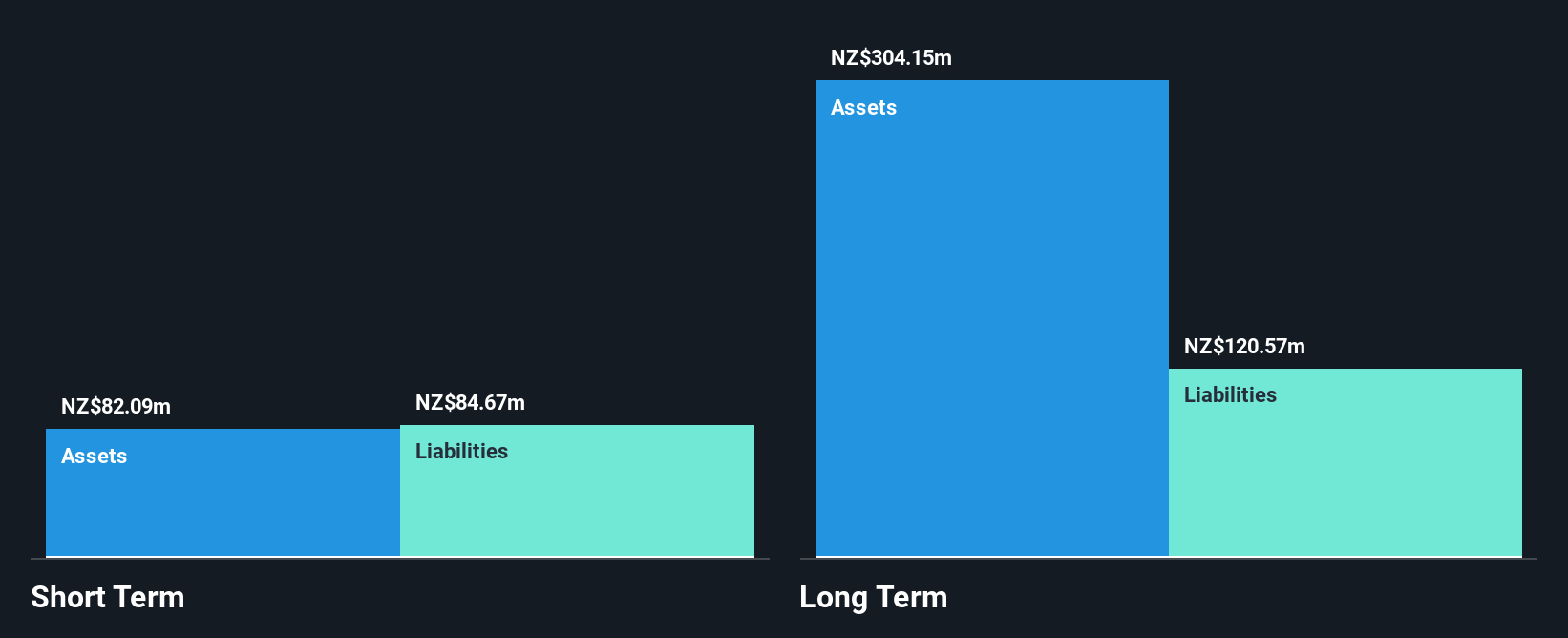

Green Cross Health's recent earnings report for the half year ended September 30, 2024, showed stable performance with sales of NZ$259.88 million and net income of NZ$5.65 million. Despite a slight decline in profit margins from 2.7% to 2.4%, the company's debt is well-covered by operating cash flow, indicating solid financial management. However, short-term assets fall short of covering both short-term and long-term liabilities, which could pose liquidity challenges. The stock trades significantly below its estimated fair value but has experienced high volatility recently, reflecting market uncertainty despite its seasoned management team and board expertise.

- Take a closer look at Green Cross Health's potential here in our financial health report.

- Examine Green Cross Health's past performance report to understand how it has performed in prior years.

Millennium & Copthorne Hotels New Zealand (NZSE:MCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Millennium & Copthorne Hotels New Zealand Limited owns, operates, manages, leases, and franchises hotels in New Zealand and Australia with a market cap of NZ$287.96 million.

Operations: The company's revenue is primarily derived from its hotel operations (NZ$109.52 million), supplemented by income from investment property (NZ$2.58 million), residential land development (NZ$32.85 million), and residential property development (NZ$25.98 million).

Market Cap: NZ$287.96M

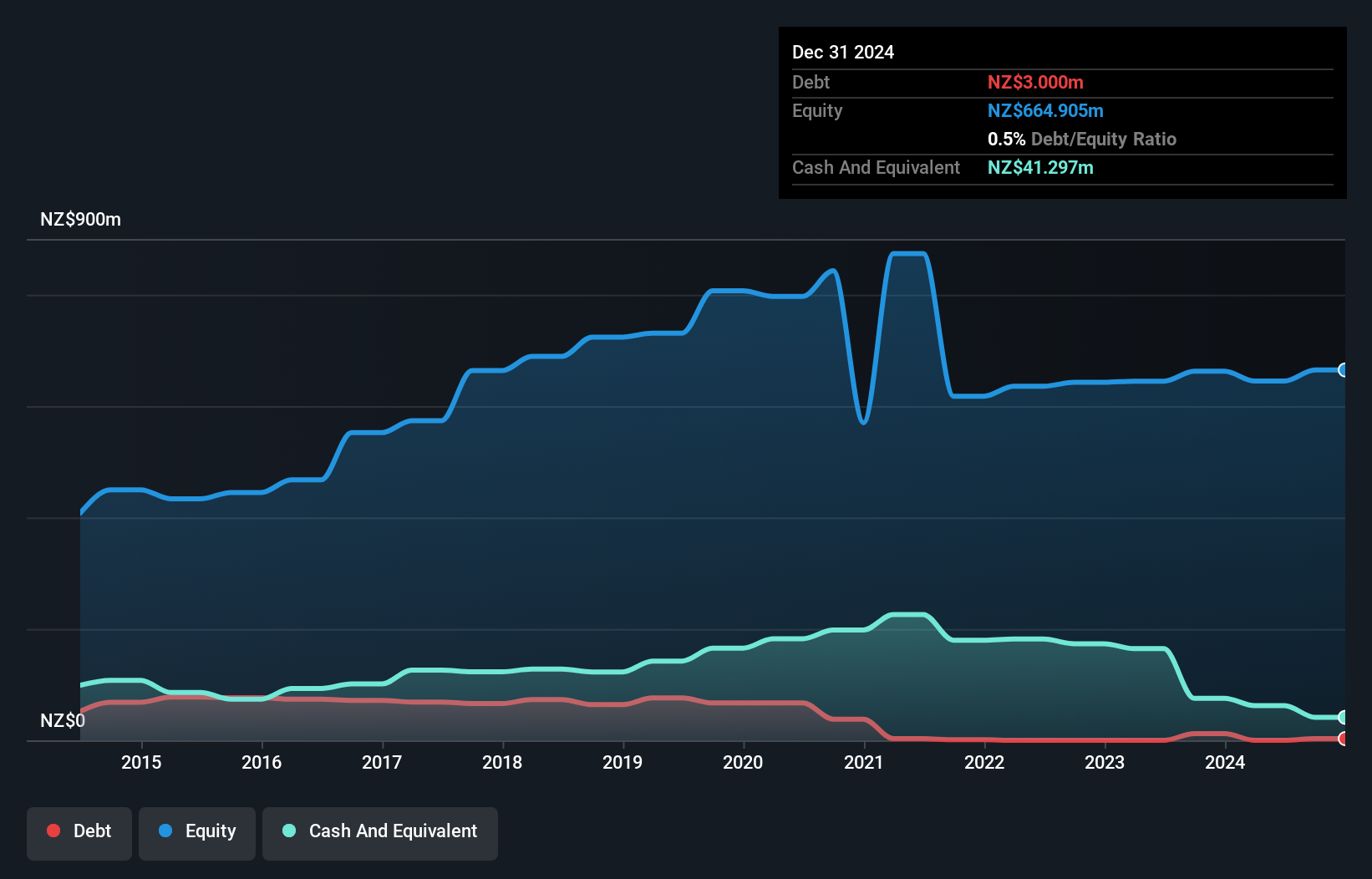

Millennium & Copthorne Hotels New Zealand Limited operates without debt, a positive shift from five years ago. However, its earnings have declined by 28.7% annually over the past five years, with recent net profit margins dropping to 2.2% from last year's 10.4%. Despite this, the company's short-term assets of NZ$156 million comfortably cover both short-term and long-term liabilities. The stock is trading significantly below its estimated fair value but has experienced stable weekly volatility at 4%. While management tenure data is lacking, the board's average tenure indicates experience at 6.2 years.

- Click to explore a detailed breakdown of our findings in Millennium & Copthorne Hotels New Zealand's financial health report.

- Explore historical data to track Millennium & Copthorne Hotels New Zealand's performance over time in our past results report.

Summing It All Up

- Dive into all 5,826 of the Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10