Root stock slumps after JMP downgrades to Perform after YTD stock surge

3D_generator

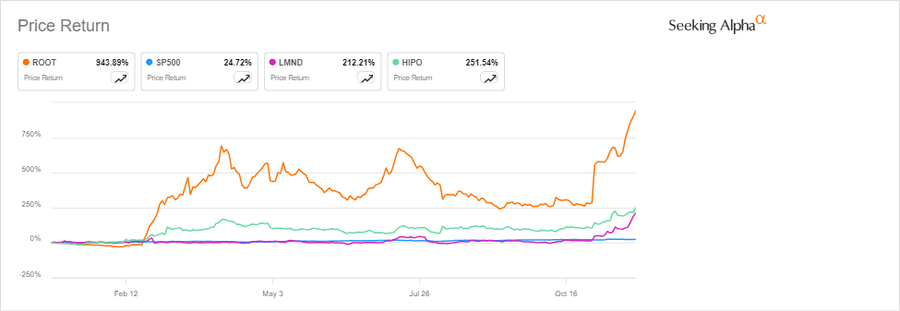

Root (NASDAQ:ROOT) stock dropped 2.4% in early Friday trading after JMP downgraded the insurtech to Market Perform following the sector's recent stock rally, with ROOT rising more than 10-fold year to date.

Root surges year-to-date, outpacing peers, S&P (Seeking Alpha)

The run-up reflects improvements in underlying profitability, along with a return to solid growth, JMP analyst Matthew J. Carletti said. While he sees the valuation as fair, "we struggle to come up with the desired upside from current levels to continue to support a Market Outperform rating," he wrote in a note to clients.

Specifically, Root (NASDAQ:ROOT) needs "to walk the tightrope of strong loss ratios (which it has done for several quarters now) alongside continued solid growth," Carletti said. In addition, the company's larger peers are likely to pursue growth in coming quarters, making it more difficult for Root to thread the needle, though he still sees it as attainable.

In JMP's insurtech update, Carletti reaffirms Lemonade (LMND) at Market Outperform and lifts its price target to $60 from $40 and reaffirms Hippo's (HIPO) Market Outperform rating while boosting its price target to $35 from $25.

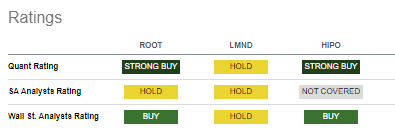

JMP's Market Perform rating contrasts with the SA Quant rating of Strong Buy and the average Wall Street rating of Buy.

Comparison of ratings for ROOT, LMND, HIPO (SA data compilation)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10