Trade Alert: Non-Executive Director Of Tian Ge Interactive Holdings Xiangdong Xiong Has Sold Stock

Some Tian Ge Interactive Holdings Limited (HKG:1980) shareholders may be a little concerned to see that the Non-Executive Director, Xiangdong Xiong, recently sold a substantial HK$15m worth of stock at a price of HK$0.58 per share. That diminished their holding by a very significant 65%, which arguably implies a strong desire to reallocate capital.

View our latest analysis for Tian Ge Interactive Holdings

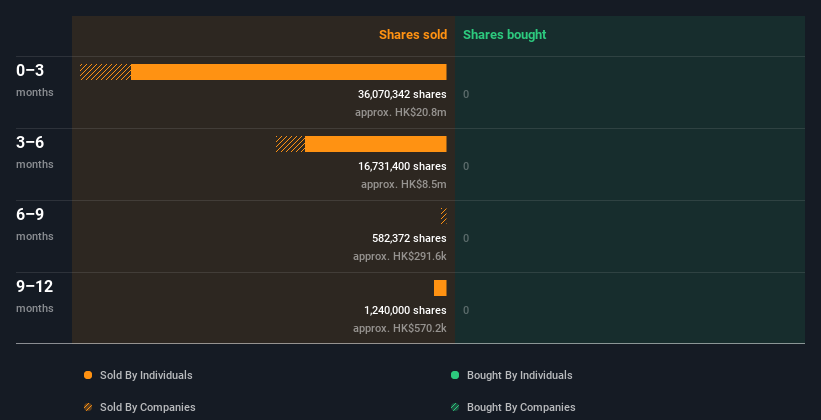

Tian Ge Interactive Holdings Insider Transactions Over The Last Year

In fact, the recent sale by Xiangdong Xiong was the biggest sale of Tian Ge Interactive Holdings shares made by an insider individual in the last twelve months, according to our records. So what is clear is that an insider saw fit to sell at around the current price of HK$0.57. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

Xiangdong Xiong divested 46.27m shares over the last 12 months at an average price of CN¥0.56. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Tian Ge Interactive Holdings insiders own about HK$214m worth of shares. That equates to 35% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Tian Ge Interactive Holdings Insiders?

An insider sold Tian Ge Interactive Holdings shares recently, but they didn't buy any. And even if we look at the last year, we didn't see any purchases. It is good to see high insider ownership, but the insider selling leaves us cautious. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Tian Ge Interactive Holdings. When we did our research, we found 5 warning signs for Tian Ge Interactive Holdings (2 are a bit concerning!) that we believe deserve your full attention.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Tian Ge Interactive Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10