Emerson’s shares rise on AspenTech deal, quarterly results

Aziz Shamuratov

Emerson Electric’s (NYSE:EMR) stock rose 4.9% to $115.15 a share in premarket trading on Tuesday after the maker of electrical equipment and automation technology said it offered to acquire the remaining shares of AspenTech (AZPN) and its quarterly profit beat Wall Street estimates.

The company proposed to buy AspenTech’s (AZPN) shares for $240 a share, a 35% premium to the industrial software company’s share price of $177.84, implying an enterprise value of $15.1 billion.

Emerson (EMR) is among the industrial conglomerates that have sought to remake themselves with higher-margin businesses such as factory automation while dispensing with less profitable parts of their portfolios.

“The combination of Emerson and AspenTech would advance key initiatives, create new opportunities through full integration as a single company and further accelerate Emerson's industrial software strategy with benefits,” Emerson (EMR) said in a news release.

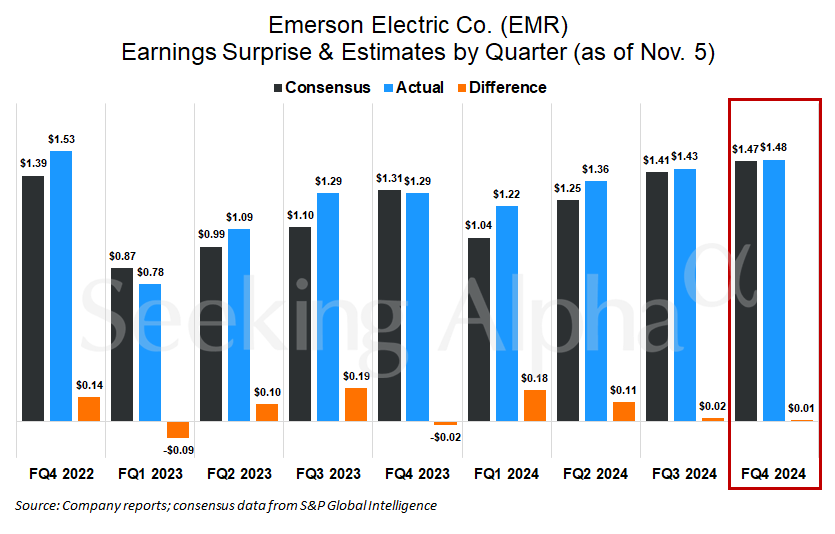

Separately, Emerson (EMR) reported earnings adjusted for one-time items of $1.48 a share, in line with the average estimate of $1.47 a share among Wall Street analysts. Revenue rose 13% from a year earlier for the company’s fiscal fourth quarter ended September 30.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10