3 US Growth Stocks With Insider Ownership Expecting 32% Revenue Growth

As the U.S. stock market navigates a period of volatility, with the Nasdaq snapping a seven-week winning streak and major indices experiencing losses, investors are closely watching growth companies that demonstrate resilience and potential for significant revenue increases. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 25.4% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 41.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Click here to see the full list of 195 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Here we highlight a subset of our preferred stocks from the screener.

Community West Bancshares (NasdaqCM:CWBC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Community West Bancshares is the bank holding company for Central Valley Community Bank, offering commercial banking services to small and middle-market businesses and individuals in California's central valley, with a market cap of $352.58 million.

Operations: The company generates revenue primarily through its banking operations, totaling $95.15 million.

Insider Ownership: 11.9%

Revenue Growth Forecast: 18.4% p.a.

Community West Bancshares is experiencing significant earnings growth, forecasted at 73.8% annually, outpacing the US market. Despite a lower return on equity projection of 10.1%, insider buying has been more frequent than selling recently. The company trades at a substantial discount to its estimated fair value and analysts predict a stock price increase of 20.9%. However, recent earnings reports show decreased net income and profit margins compared to last year, and shareholders faced substantial dilution over the past year.

- Click to explore a detailed breakdown of our findings in Community West Bancshares' earnings growth report.

- The analysis detailed in our Community West Bancshares valuation report hints at an deflated share price compared to its estimated value.

Establishment Labs Holdings (NasdaqCM:ESTA)

Simply Wall St Growth Rating: ★★★★★☆

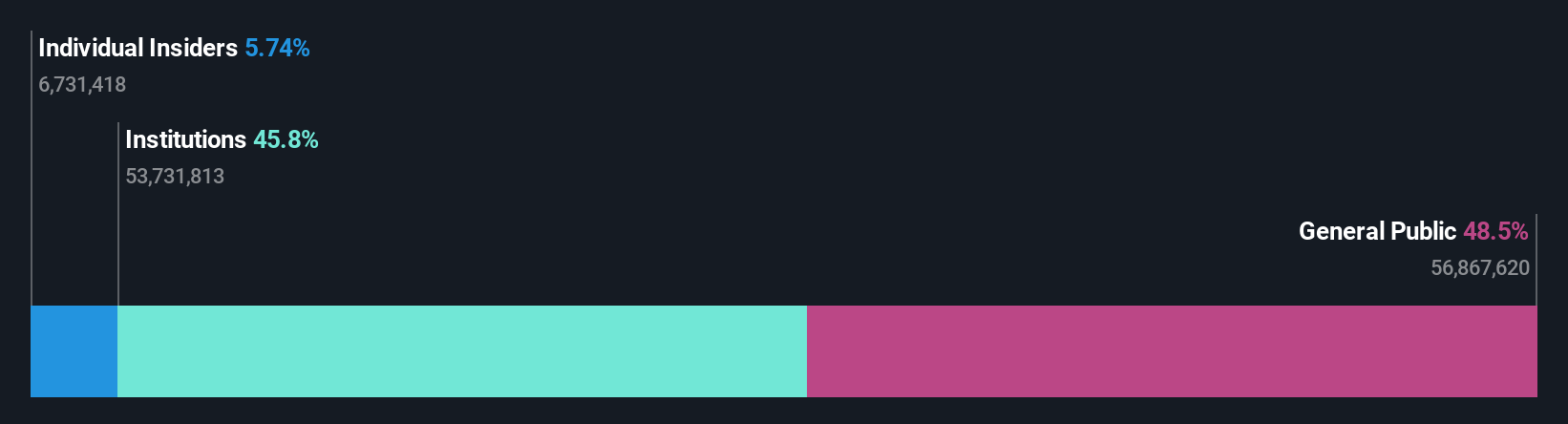

Overview: Establishment Labs Holdings Inc. is a medical technology company that manufactures and markets medical devices for aesthetic and reconstructive plastic surgery, with a market cap of approximately $1.27 billion.

Operations: The company generates revenue primarily from its medical products segment, amounting to $151.35 million.

Insider Ownership: 10.1%

Revenue Growth Forecast: 23.9% p.a.

Establishment Labs Holdings is poised for strong revenue growth, forecasted at 23.9% annually, surpassing the US market average. Despite recent financial losses and a volatile share price, the company expects profitability within three years. Recent FDA approval of Motiva Implants in the US marks a significant milestone, potentially driving future sales. However, past shareholder dilution remains a concern. The stock trades significantly below its estimated fair value, presenting potential upside opportunities for investors mindful of risks.

- Delve into the full analysis future growth report here for a deeper understanding of Establishment Labs Holdings.

- In light of our recent valuation report, it seems possible that Establishment Labs Holdings is trading beyond its estimated value.

Intuitive Machines (NasdaqGM:LUNR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intuitive Machines, Inc. designs, manufactures, and operates space products and services in the United States with a market cap of approximately $1.04 billion.

Operations: The company generates revenue from its Aerospace & Defense segment, amounting to $157.77 million.

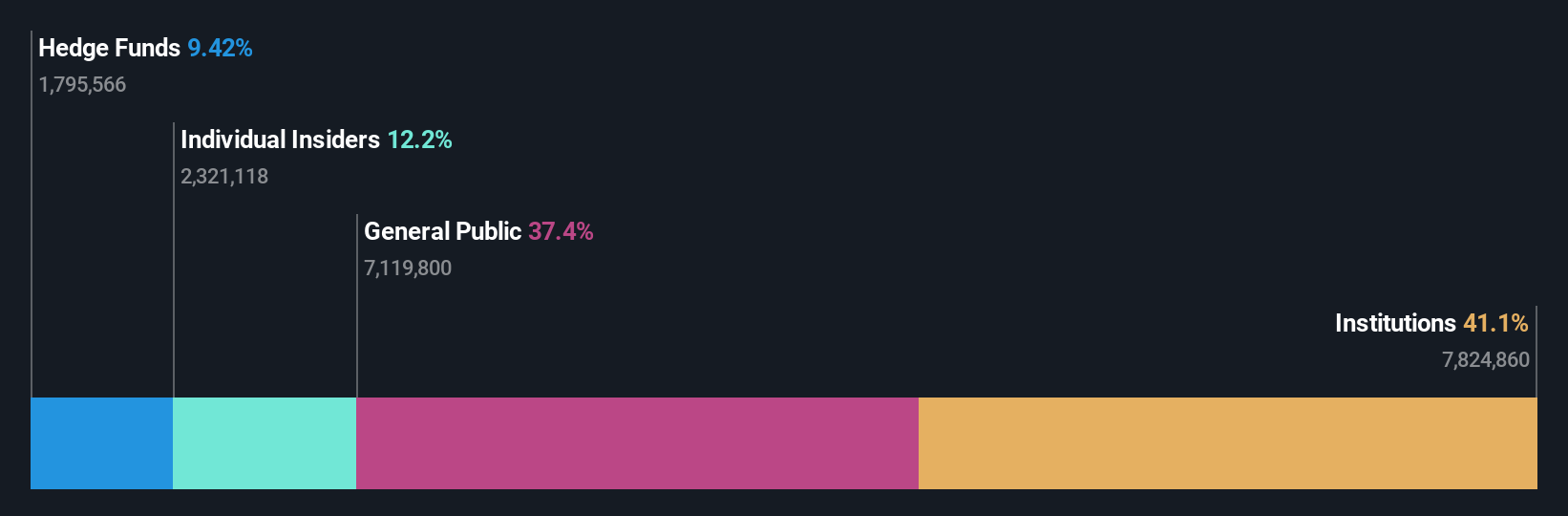

Insider Ownership: 14.8%

Revenue Growth Forecast: 32.8% p.a.

Intuitive Machines is forecasted for robust revenue growth at 32.8% annually, outpacing the US market. Despite recent volatility and shareholder dilution, the company anticipates profitability within three years. Insider activity shows more buying than selling recently, indicating confidence in its trajectory. A significant NASA contract worth up to US$4.82 billion underscores its strategic importance in lunar missions, enhancing long-term prospects despite current financial challenges and a limited cash runway.

- Get an in-depth perspective on Intuitive Machines' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Intuitive Machines' share price might be too pessimistic.

Key Takeaways

- Explore the 195 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10