MicroStrategy Stock Hits Highest Level in 24 Years, Outperforms Bitcoin

- MicroStrategy stock reached a new high, outperforming Bitcoin with a 470% increase in 2024.

- BlackRock’s investment increased MicroStrategy's stock momentum, with shares up 125% in September alone.

- MicroStrategy now holds 252,220 BTC, valued at 80% above its acquisition cost, amid robust Bitcoin market interest.

MicroStrategy (MSTR) shares have reached a new high as Bitcoin price surged past $71,000. Year-to-date, MSTR has shown stronger performance than BTC.

With BlackRock stepping up its investment, MSTR has soared its highest level in 24 years.

MicroStrategy Shares Soar 470% in 2024

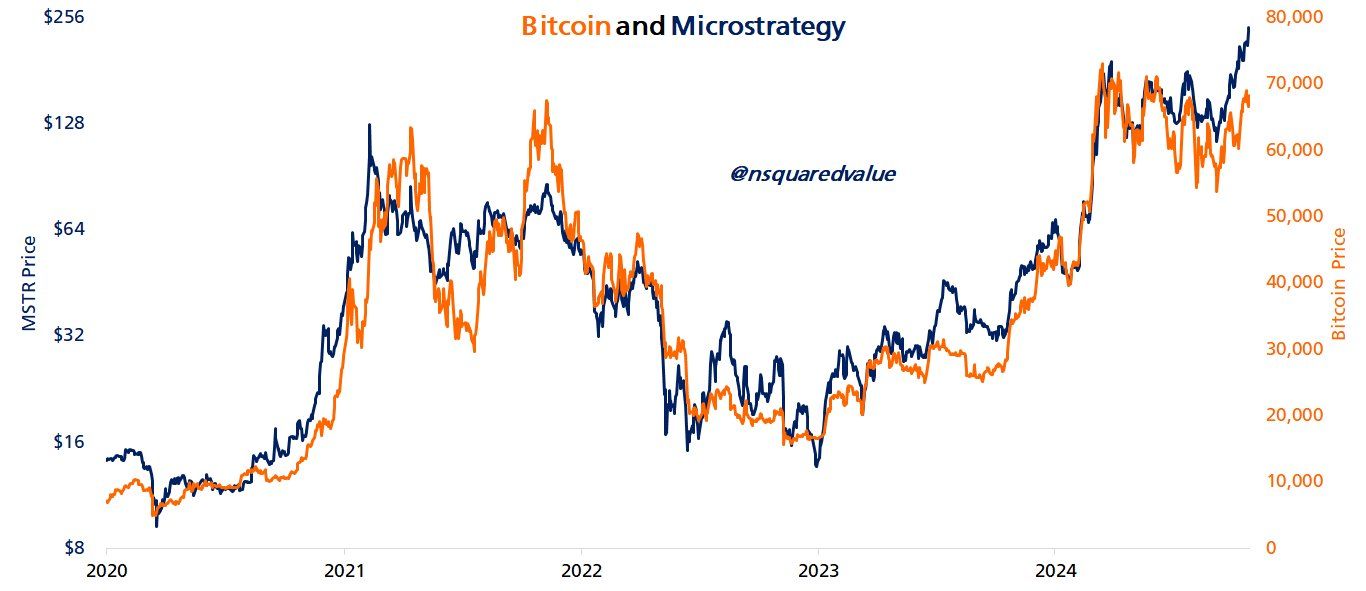

Today, MSTR reached a peak of $260 per share. The stock gained 125% in September alone and has surged 470% since the start of the year. While Bitcoin has yet to break its previous highs, MSTR surpassed its earlier peak at the start of October and has been climbing ever since.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

MicroStrategy’s momentum is fueled by news that investment giant BlackRock has raised its stake in the company to 5.2%. Alongside its Bitcoin purchases through ETFs, BlackRock’s investment in a company closely tied to Bitcoin seeks to maximize returns.

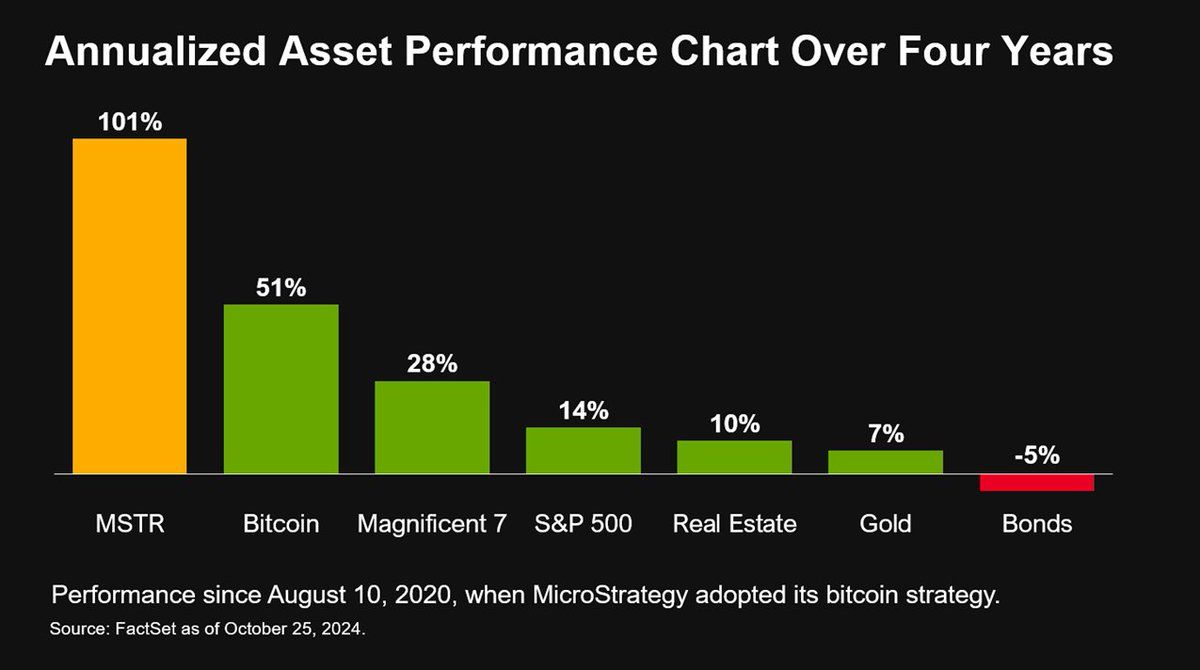

MicroStrategy Founder Michael Saylor also recently highlighted that MSTR has outperformed not only Bitcoin but also many other assets.

In 2024, the company has consistently issued bonds to buy Bitcoin. Last month, MicroStrategy issued $700 million in bonds, following a $800 million bond offering in June. Currently, MicroStrategy holds the largest public company Bitcoin reserve, with 252,220 BTC, accounting for 1.2% of the total supply. The average purchase price is around $39,266 per BTC, representing a gain of over 80%.

Some industry experts predict that the correlation between MSTR stock and BTC will continue to fuel further gains in MicroStrategy’s share price.

“MicroStrategy approximates a 2x leveraged Bitcoin ETF. Here are the implied values for MSTR at various BTC prices: $70,000 => $235, $80,000 => $300, $90,000 => $365, $100,000 => $440,” analyst Timothy Peterson projected.

Read more: Who Owns the Most Bitcoin in 2024?

However, investor PlanG takes a more cautious view when analyzing MSTR’s price on a log-linear chart.

“I think a lot of the degen people that were doing all sorts of degen things with crypto are doing the same thing with MSTR. I love MSTR but this is not sustainable. Straight line in a log-linear chart means exponential. I think several people will get hurt,” PlanG commented.

Meanwhile, Bitcoin also surpassed $71,000 today, marking its highest level since July. Investor sentiment toward Bitcoin has turned bullish as the US election approaches in less than a week.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10