SVAL: A Little Too Much Financials Exposure

Maskot

Both small-caps and value have been out of favor for over a decade, as investors favored large-cap names that tilted towards growth. I don't know about you, but I don't think that cycles have gone away, and I very much believe the next cycle will favor both small and value. If you're of the same mindset, then you may want to consider the iShares US Small Cap Value Factor ETF (BATS:SVAL). This ETF aims to track small-cap stocks with strong value characteristics using a rules-based approach.

SVAL benchmarks itself against the Russell 2000 Focused Value Select Index. This index contains small-cap U.S. stocks. The key word here is focused. While there are many small-cap stocks out there, the fund only selects 250 US small-cap companies which have strong value metrics, making it more centered around value than perhaps some other funds that are trying to play in the same space.

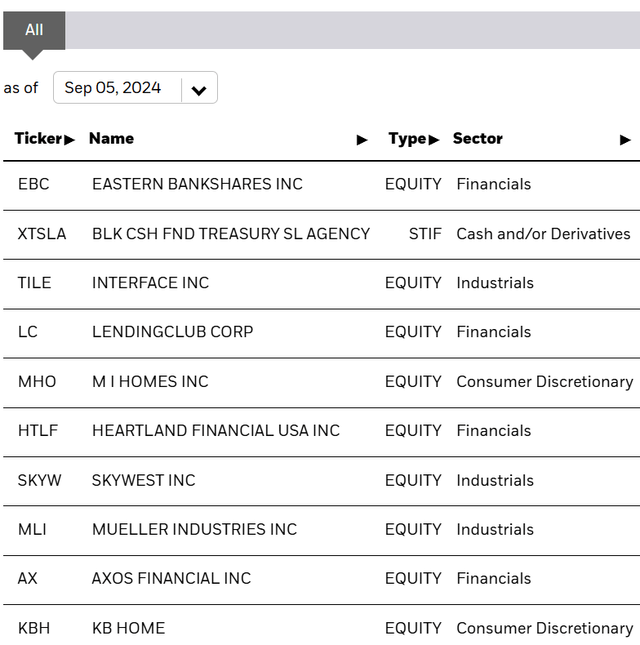

A Look At The Holdings

All stock positions in the fund have a weighting of less than 1%. This is well diversified overall. When positions are this small, what the companies individually do doesn't matter all that much, as it's more about the factors and commonalities shared in terms of fundamentals.

ishares.com

The holdings result in a portfolio that candidly looks cheap. The Price to Earnings ratio is 11.14, and the Price to Book stands at 1.21. If you're looking for value, this is clearly the way to get it.

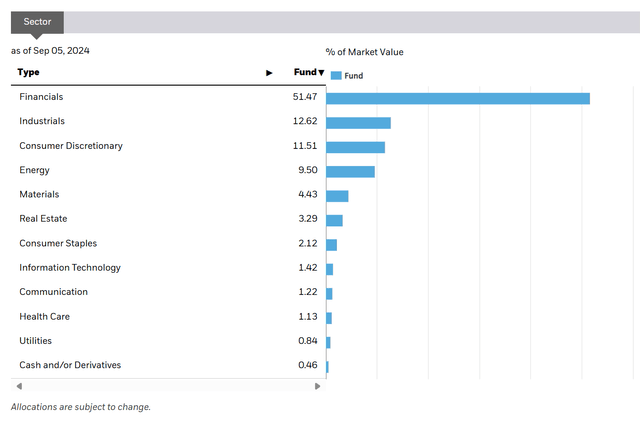

Sector and Global Allocation

Herein lies the big issue, which could either be a good thing or a bad thing depending on what comes next to markets and the economy. While the fund is clearly diversified given the weightings of individual stocks and number of positions, it is HEAVILY focused on Financials. Now to be fair, Financials often dominated a value tilted portfolio, but it's extreme here at over 51%.

ishares.com

Maybe this is an opportunity. A lot of Financials have been beaten down post the regional banking crisis of last year. But just keep in mind the sector risk here. It can be a positive, but also means the fund is highly concentrated.

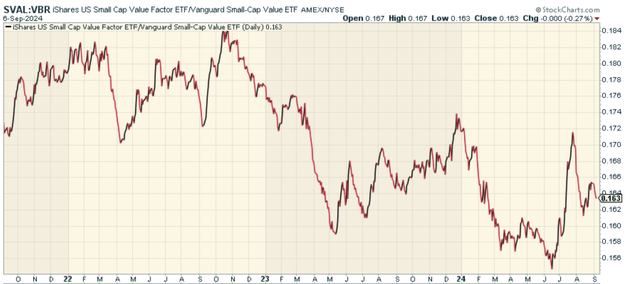

Peer Comparison

One fund worth comparing this against is the Vanguard Small-Cap Value ETF (VBR). This is a more comprehensive value fund, with Financials there making up just 21% of the fund by comparison. It also has over 2x the number of holdings as SVAL. When we look at the price ratio of the two relative to each other, we find that SVAL has underperformed meaningfully. Not a surprise - the Financial sector has been challenging in the fastest rate hiking cycle in history.

stockcharts.com

Pros and Cons

On the plus side, the fund gives you a chance to invest in a part of the market that many portfolios often leave out. Small-cap value stocks have a track record of delivering good returns when the economy is bouncing back and undervalued companies can show what they're worth. The ETF spreads your investment across many different holdings, which helps cut down the risk you'd face if you invested in small-cap stocks one by one. This spread-out approach also helps protect against market ups and downs.

Unfortunately, that spreading out of risk doesn't apply to sector allocation here. Financials being such a large weighting is a risk. And generally speaking, small-cap stocks have more ups and downs than large-cap ones, and value stocks can stay underpriced for a long time. So long as investors love large-cap Tech, momentum can continue to be challenged, no matter how attractive valuations get.

Conclusion

I have mixed feelings on this one. I'm actually bullish on Financials, but don't know if I'd want to have that much exposure in a diversified portfolio like this. Yes - the iShares US Small Cap Value Factor ETF gives investors a small-cap portfolio with very attractive core fundamentals, but it might just have too much risk in the regionals to make it worth considering, unless you're particularly bullish on that part of the marketplace (in which case I'd say go for a fund focused on just that sector). Worth keeping on your investment radar, though.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10