Summary: Gaotu Techedu Inc. will release its second-quarter 2025 financial results before the market opens on August 26th. Revenue is expected to achieve year-over-year growth, possibly exceeding the upper limit of guidance, and high-end business growth is expected to exceed expectations. The effectiveness of its AI strategy will be a key focus.

First Quarter 2025 Highlights

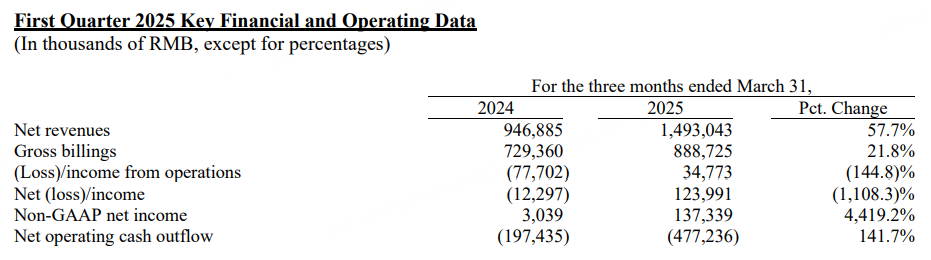

• Net revenues were RMB1,493.0 million, increased by 57.7% from RMB946.9 million in the same period of 2024.

• Gross billings[2] were RMB888.7 million, increased by 21.8% from RMB729.4 million in the same period of 2024.

• Income from operations was RMB34.8 million, compared with loss from operations of RMB77.7 million in the same period of 2024.

• Net income was RMB124.0 million, compared with net loss of RMB12.3 million in the same period of 2024.

• Non-GAAP net income was RMB137.3 million, increased by 4,419.2% from RMB3.0 million in the same period of 2024.

• Net operating cash outflow was RMB477.2 million, compared with RMB197.4 million in the same period of 2024.

According to the company's forecast in its first-quarter financial report, total net revenue for the second quarter is expected to be between RMB 1.298 billion and RMB 1.318 billion, representing year-over-year growth of 28.5% to 30.5%.

According to Bloomberg, analysts generally expect Gaotu to report second-quarter revenue of RMB 1.319 billion and adjusted earnings per share of -RMB 1.06.

Key Highlights

Leveraging AI to Improve Teaching Quality and Operational Efficiency

Gaotu launched "Gaotu Famous Teacher AI Customized Learning." Leveraging its "three-teacher model" (famous teacher + tutor + AI learning companion), Gaotu leverages AI to deeply analyze student learning data, pinpoint weaknesses, and dynamically adjust learning paths, truly achieving "tailored teaching" and scientifically improving efficiency. Furthermore, Gaotu has partnered with Feishu to integrate capabilities like multi-dimensional spreadsheets and its intelligent agent development platform, Feishu Aily, into Gaotu's entire business chain, providing a new path for the deep integration of "education + AI."

Continuous Improvement in Future Profitability

While the company boasts rapid revenue growth, it maintains strong cost control. Whether it can achieve significant loss reduction in Q2 remains to be seen. Going forward, the company's internal process optimization and efficiency improvements, AI-enabled cost reduction, and improved profitability in its offline business are expected to drive continued growth in gross profit margin and optimize its expenses.

Institutional Views

BOCOM International maintains a "buy" rating on Gaotu with a target price of US$4.80. The K12 business is growing steadily, coupled with the upgrade of AI+education strategy, and we are optimistic about its long-term profitability.