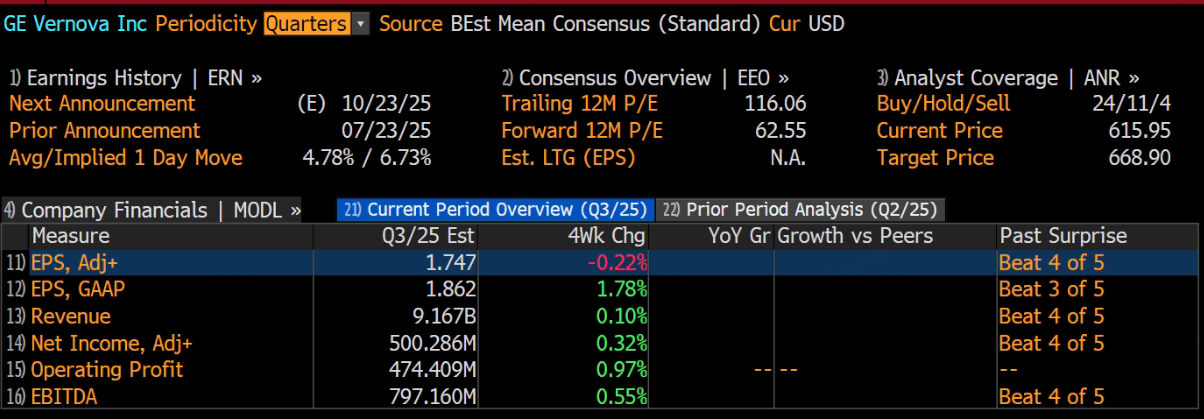

GE Vernova will announce its fiscal year 2025 third-quarter earnings before the market opens on October 22, 2025, Eastern Time. According to Bloomberg's consolidated analyst expectations, GE Vernova is expected to report Q3 revenue of $9.167 billion, up 2.85% year-on-year; adjusted earnings per share (EPS) are projected to be $1.75.

Last Quarter Review

In the second quarter of 2025, GE Vernova outperformed expectations with revenue of $9.11 billion, a year-on-year increase of 11%. Adjusted EPS was $1.77, a significant year-on-year increase of 73%. The company also raised its full-year revenue forecast, expecting to reach the high end of the $36-37 billion range, and adjusted EBITDA margin forecast was raised to 8-9%.

Management provided guidance for the third quarter: expected revenue of $9.2-9.4 billion, gross margin of 23-24%, and adjusted EPS of $1.65-1.85. The overall guidance is generally in line with market expectations.

Highlights This Quarter

1. Power Transition and AI-Driven Growth

GE Vernova is accelerating its transformation from a traditional energy equipment supplier to an energy technology service provider. The company holds a 24% market share in data center power systems, with modular substation solutions becoming a core supplier for cloud computing giants such as Microsoft and Amazon.

Additionally, through the acquisition of Grid Solutions, GE Vernova's intelligent grid management software revenue grew by 37% year-on-year, driving the proportion of service revenue to 58%. These strategic deployments will further drive its sustained growth in the future, especially in the digital grid and energy management sectors.

2. Wind Power Business Pressure

Despite GE Vernova's strong performance in the power and services sectors, the wind power business continues to face challenges. The company reported an EBITDA loss of $165 million in the second quarter for the wind power business, reflecting the ongoing volatility in this segment. Although the company has achieved solid progress in other areas, the execution progress of wind power projects and market demand fluctuations may impact overall financial performance, particularly as the wind power market undergoes structural adjustments globally.

3. Geopolitical Dividends

The EU's carbon tariff policy has driven a 19% increase in GE Vernova's orders in Europe, with the market penetration rate of offshore wind power connectors in Germany surpassing 15%. This policy advantage presents a significant market opportunity for GE Vernova, potentially supporting its business expansion in the European region.

It is worth noting that GE Vernova's high debt ratio (79% debt-to-asset ratio) may face refinancing pressure on $3.4 billion of floating rate debt during the Federal Reserve's rate-hike cycle. Additionally, Siemens Energy's new generation of hydrogen turbines entering the testing phase could threaten GE Vernova's market share in the gas power equipment sector.

Conclusion

Despite short-term uncertainties in the wind power business, GE Vernova's power services and technological layout in AI and smart grids will provide the company with mid- to long-term growth momentum.

Overall, GE Vernova's earnings report is expected to confirm the trend of profit recovery, with high-margin orders in the grid and services businesses driving revenue and margin growth. However, short-term volatility in the wind power business still requires attention and may impact the company's overall profitability performance.

This content is generated based on tiger AI and Bloomberg data, for reference only.