Abstract: Biopharmaceutical giant AstraZeneca will release its second quarter 2025 financial report before the market opens on July 29. The market generally expects its revenue and profits to continue to maintain good growth.

First quarter performance review

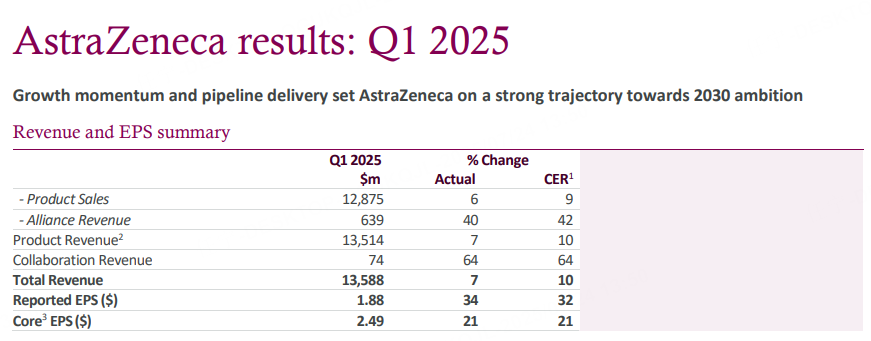

In the first quarter of 2025, AstraZeneca's revenue was US$13.588 billion, a year-on-year increase of 10%, of which product sales reached US$12.875 billion, a year-on-year increase of 9%; R&D investment was US$3.159 billion, a year-on-year increase of 15%.

In the first quarter, AstraZeneca's revenue in the United States was US$5.646 billion, a year-on-year increase of 10%, accounting for 42% of total revenue; China's revenue was US$1.805 billion, a year-on-year increase of 5%, accounting for 13% of total revenue. Currently, China is AstraZeneca's third largest market after the United States and Europe.

Second quarter expectations

The market generally believes that AstraZeneca's second quarter revenue is expected to reach US$14 billion to US$14.2 billion, with a year-on-year growth rate close to the high single-digit to low double-digit range; gross profit margin is likely to remain at about 35%; net profit margin is expected to be around 20%, and adjusted earnings per share are expected to be around US$2.60 to US$2.70.

According to Bloomberg data, analysts expect AstraZeneca's comparable sales in the second quarter to be US$14.119 billion, a year-on-year increase of 9.14%; adjusted earnings per share to be US$2.17, a year-on-year increase of 9.49%.

Main highlights

Promotion of core products

Sales of many of the company's core drugs performed well in the last quarter, and the trend is expected to be further strengthened this quarter. The demand for drugs for lung cancer and breast cancer is still high, and sales are expected to remain stable. Management may increase marketing investment in star products and increase the market penetration of tumor treatment drugs by strengthening cooperation with hospitals and professional institutions. It is necessary to observe whether the core products can have a positive impact on cash flow in the second quarter.

External cooperation and R&D investment

The company continued to increase external cooperation or M&A investment this quarter to obtain stronger R&D capabilities and more new drug licenses. This strategy is conducive to AstraZeneca's continued introduction of innovative therapies and advanced technologies. Some key clinical trials are entering the late stage. If positive data can be obtained and regulatory approval is successfully obtained, investor sentiment will be significantly boosted. External cooperation is not simply to expand the product line, but also to strengthen its own technology accumulation and core R&D capabilities. This investment can increase growth potential.

Rich product lines and business layout provide support

If the revenue growth trend of the previous quarter can be continued this quarter and stable profitability can be maintained, the market's expectations for its valuation may be further raised. Overall, the company's diversified product lines and relatively stable business layout will become the main support points in the next stage, and also lay the foundation for it to gain more space in the fierce competition in the pharmaceutical field.